There is one consistent question Eduventures has fielded often over the last few months: once the pandemic is behind us, where will the high growth job sectors lie? It’s an important question facing schools as they consider how their academic program offerings stack up against evolving labor market needs.

The temptation to make knee-jerk reactions in this environment can be strong. But given the long list of variables and unknowns, Eduventures recommends focusing on two fundamentals when investigating the current and post-COVID labor market.

An Uneven Recovery

The question of high growth labor market opportunities is never straightforward, complicated even more by uneven U.S. economic recovery. Dubbed by economists as “K-shaped,” the U.S. Chamber of Commerce expects recovery to be “vigorous for some sectors while others remain in free fall.”

As the Chamber notes, the technology, software services, and retail sectors are on the mend, while travel, entertainment, hospitality, and food services are still in desperate need of assistance. Viewed another way, the current economic recovery is also seeing disparate performances between high and low paying jobs.

The organization Opportunity Insights reports that high wage employment (defined as more than $60,000 per year) has largely recovered from COVID-19 stress. This represents only a -1.6% jobs decline, compared to -16% for low wage employment (less than $27,000) from February 2020 to August 2020. Given the nature of the current recovery, the challenge for institutions becomes identifying both high growth sectors and high paying jobs within them.

The Bachelor's Job Posting Landscape: Before and During COVID-19

Let’s take bachelor’s occupations as an example. In greener pastures—or September 2019 in this case—Emsi reported 3.1 million unique job postings in the U.S. where a bachelor’s degree is required or preferred. Fast forward to September 2020, this number was 2.4 million, a 23% decline. But a deeper dive shows that, though contracted, labor market composition hasn’t really changed.

Figure 1 shows the top 10 occupations in both September 2019 and September 2020—accounting for one-third of all postings mentioning a bachelor’s—including the number of unique job postings seen in those months and their share of overall job postings during these windows.

Top Ten Bachelor's Occupations Featured in Job Postings Data

September 2019 and September 2020

| September 2019 | September 2020 | ||||

|---|---|---|---|---|---|

| Top Posted Occupations | # of Unique Postings | Share of 3.1 Million Postings | Top Posted Occupations | # of Unique Postings | Share of 2.4 Million Postings |

| Software Developers | 211,344 | 7% | Software Developers | 169,465 | 7% |

| Registered Nurses | 136,550 | 4% | Registered Nurses | 138,775 | 6% |

| Computer Occupation, All Other | 109,672 | 4% | Computer Occupation, All Other | 89,682 | 4% |

| Accountants and Auditors | 103,597 | 3% | Marketing Managers | 69,321 | 3% |

| Marketing Managers | 92,565 | 3% | Accountants and Auditors | 68,284 | 3% |

| Sales Managers | 71,814 | 2% | Network and Computer Systems Administrators | 45,882 | 2% |

| Management Analysts | 64,103 | 2% | Management Analysts | 45,346 | 2% |

| Industrial Engineers | 62,310 | 2% | Financial Managers | 45,346 | 2% |

| Computer Systems Analysts | 60,861 | 2% | Sales Managers | 44,978 | 2% |

| Financial Managers | 60,703 | 2% | Computer Systems Analysts | 44,627 | 2% |

Figure 1.

Source: Eduventures analysis of Emsi Data

This view reveals that no seismic shifts have occurred for top occupations seeking candidates with bachelor’s degrees. Although there is some variance in order, nine of the top 10 posted occupations remain the same—only network and computer systems administrators have replaced industrial engineers. Registered nurses, the only occupation to see a change in share of total postings, moves from 4% to 6%—not a major surprise on the heels of a global health event.

Finally, the 2020 job postings mentioning a bachelor’s degree report a median salary of $62,400, meeting the $60,000 threshold. By this account, the outlook for those with a bachelor’s degree or above, long the bread-and-butter degree of four-year schools, appears quite solid. When the pandemic subsides, most bachelor’s job volume should return.

Following the Job Data

If job posting data shows that the labor market for bachelor’s holders, though smaller, is largely unchanged in terms of top sought-after occupations, it follows that the most recent occupational projection data available still paints an accurate picture for future demand.

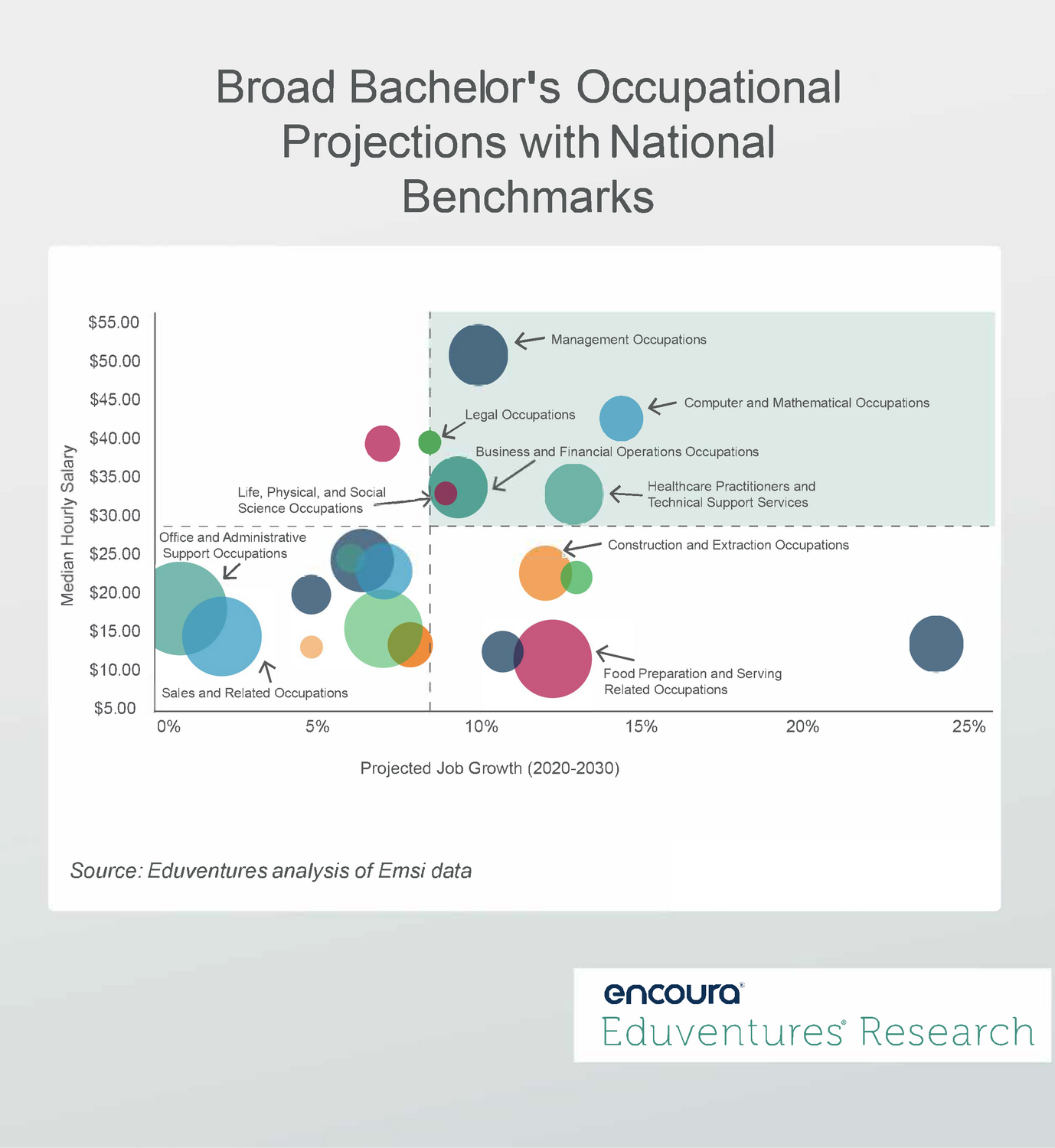

Figure 2 plots the major occupational categories by projected 2020-2030 job growth rate (x-axis), median hourly salary (y-axis), and the occupational field size in 2020 (indicated by circle size). This data is benchmarked against the projected national average job growth during this period (8%) and the U.S. median hourly wage (about $28) for those with at least a bachelor’s degree.

Figure 2.

This highlights six broad bachelor’s occupational categories that are both projected to grow faster than the national bachelor’s average, and lead to salaries greater than the national median for those with a bachelor’s degree: management, computer and mathematical, healthcare practitioners/technical support services, legal, life/physical/social science, and business/financial operations.

Connecting the Dots Amid the Noise

When looking at the two data sets together, all of the top-posted occupations in September 2020 (Figure 1) fall neatly into the six broad occupational categories (Figure 2) projected to see both faster growth and higher earnings over the next decade. Those two metrics combined can serve as a useful roadmap for more granular exploration of specific jobs within these categories, and provide a critical national benchmark. Without them, institutional leaders may be susceptible to ubiquitous and potentially dubious articles and blogs that often focus on high paying occupations but below average growth.

Another effective way to link this data to program opportunities is thinking about cross-occupational skills. An increasing number of schools are taking this skills-based approach—making connections across occupational areas to identify programs that offer multiple career trajectories and cross-sector skills.

For example, a recent crop of healthcare innovation programs have been developed by schools like Arizona State University, Ohio State University, and University of Pennsylvania to equip students with skills to lead health systems into the future. According to the National Center for Education Statistics, these programs include instruction in “innovation management, medical device development, evidence-based practice, systems thinking, information technology, healthcare policy and finance, organizational change, and leadership.” Notably, finance, IT, management, and the other skills listed show much alignment to the six broad occupational categories highlighted for opportunity in this post.

Bachelor’s occupations outside the job postings Top 20 and the top right quadrant of Figure 2 also merit closer attention, but that is for a future Wake-Up Call.

The Bottom Line

The pandemic drags on, and so does labor market uncertainty. As of October 26, weekly unemployment claims remain volatile while prospects for additional relief through a pre-election stimulus package, if not already squashed, dim by the hour.

What is certain, however, is that knee-jerk decisions made today based on short-term trends or figures taken out of context are not advised. Rather, institutional leaders must continue focusing on the long-term and follow the data: refresh job data quarterly, track trends, and map programs to the destinations the deep data is signaling.

Of course, labor market dynamics for pre- and post-bachelor’s credentials also deserve scrutiny. Please contact your Client Research Analyst if you have questions about specific fields.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Clint Raine, Eduventures Client Research Analyst at ACT | NRCCUA

Contact

Eduventures Summit 2020 Virtual Research Forum: Register Today!

Our exclusive half-day Virtual Research Forum is almost here and we have a limited number of complimentary passes still available. We invite you, our loyal Wake-Up Call readers, to join us for this event featuring world class keynote speaker Bryan Stevenson—Executive Director of the Equal Justice Initiative and the author of Just Mercy—as well as the latest research and insights from Eduventures analysts.