Followers of higher education technology all want to predict where the market is headed—often leveraging information such as investments, acquisitions, or macro trends to do so. Parsing through these tea leaves can certainly be helpful, providing insight into the ebbs and flows of the higher education technology market.

But there's another, often overlooked, approach—one that considers the areas into which new technology companies and products enter. Viewing the market through this lens sheds light on where new vendors think their products will gain the most traction or provide the most significant impact.

Drawn from our newly-released 2021 Higher Education Technology Landscape Report, today we highlight five new vendors within the two segments that have attracted the most entrants since 2016.

Where are new vendors?

Before looking into the data, we should first define what we mean by "new vendors." While some companies have come into existence since 2016, they have done so by merging other companies whose products existed before 2016—these are not the subjects of today’s post. Watermark, for example, launched in 2018 following the merger of Taskstream, TK20, and LiveText. Likewise, Anthology launched in 2020 following the combination of Campus Management, Campus Labs, and iModules.

To understand how we concentrated this analysis on those vendors that both came into existence and created unique products since 2016.

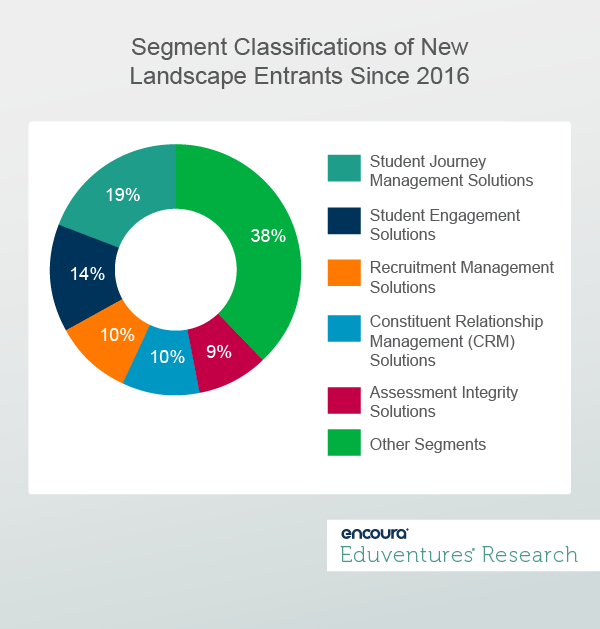

Figure 1 shows the segments with the net-new entrants in our Higher Education Technology Landscape (Landscape) since 2016 and their percentages of the entrants within their segments. The specific segments with the most entrants are:

- Student Journey Management Solutions: These solutions, like EAB's Starfish, support students on the paths they take through their higher education careers and include academic achievement, advising, career readiness, campus life, and financial aid.

- Student Engagement Solutions: These solutions, like Mongoose's Cadence, empower schools to engage with students and foster a sense of belonging, and include functionality such as enabling communication via different channels (email, text, chat) and empowering outreach and user collaboration.

Although we dive more deeply into this data as part of our 2021 Higher Education Technology Landscape Report, it might be helpful to provide some general comments here as well. First, it is important to convey that we are not saying new vendors entering these segments are responding to new focus areas of institutions—institutional leaders, for example, have long focused on improving student engagement and supporting the student journey. Instead, this data suggests that vendors are developing products in these segments because they believe they will enable institutions to achieve these ends better than what's available on the market today, either through new technology or by leveraging existing technology.

Who are the vendors to watch?

EVAN360 (Student Journey Management Solutions)

Founded in 2017, EVAN360 aims to support student needs around career services, campus services, technology, and student life. EVAN360 serves as a singular touchpoint between the student and all campus resources (career services, etc.), providing students with a one-stop shop for challenges they may face along their journeys. The company stands out within this segment because it also extends its functionality to support the students within one institution to those transferring between institutions, helping them navigate credit evaluation or course equivalencies.

AEFIS (Student Journey Management Solutions)

Beginning as an Assessment Management solution, AEFIS has extended its functionality to allow institutions to leverage similar data points (learning outcomes, assessment results, etc.) to support the student journey. Founded in 2017, AEFIS is the first vendor to attain and leverage the IMS Global Comprehensive Learner Record (CLR) Certification, a technical specification designed to support traditional academic programs, co-curricular and competency-based education, as well as employer-based learning and development. It allows students to collect, store, and share data points such as career degrees, courses, and competencies.

AstrumU (Student Journey Management Solutions)

Founded in 2017, AstrumU addresses, as a question of translation, the alignment of skills students have with skills needed in the job market. Powering its solution is an AI-enabled engine that captures current and prospective student outcomes, courses, internships, and extracurricular activities and maps them to the job market. Likewise, AstrumU is part of an evolving trend of companies that supports the notion of career readiness as a transition point along the student journey, where the outcome is the alignment of skills students have obtained with skills employers seek.

Nearpeer (Student Engagement Solutions)

Founded in 2017, Nearpeer leverages the paradigm of social media networks, such as Facebook and Instagram, to encourage students to connect. Unlike those networks, however, Nearpeer provides a specific targeted search for students looking to connect with other students sharing the same interests, coming from the exact locations, or pursuing the same areas of study. Using a powerful back-end data analytics functionality, Nearpeer also helps institutions understand the patterns and outcomes of student connections, which empowers institutions to improve a sense of community for their students, helping to improve retention in return.

Rah Rah (Student Engagement Solutions)

Founded in 2018, Rah Rah seeks to connect students with the activities and resources available to them on campus. Unlike others in this segment, however, Rah Rah identifies mobile devices and tablets as the main mechanisms for engagement. Through their handheld devices, students can discover upcoming events and social groups and the availability of services such as advising or wellness support. Like Nearpeer, Rah Rah deploys a powerful search technology, enabling students to perform searches using everyday language and receive specific results.

The Bottom Line

Taken together, these new entrants signal the areas that recent vendors believe their technologies will enable institutions to achieve these ends better than what's available on the market today. We see the focus on Student Journey Management Solutions and Student Engagement Solutions—and an evolving Career Readiness segment—strengthening over time as these vendors gain increasing market share. We also see the number of new entrants into other solutions, such as those in the Productivity and Collaboration segment (like Zoom or ClassEdu), increase as institutions begin to more deeply understand how these solutions best fit into their evolving teaching and learning approaches.

Our ongoing Landscape work will continue to identify and address gaps between institutional needs and segments in our Landscape. Our 2021 Higher Education Technology Landscape Report in Encoura Data Lab dives more deeply into the segments and vendors we highlighted today. You can download the full-size Tech Landscape image here.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at ACT | NRCCUA

Contact

Eduventures® 2021 Higher Education Technology Landscape (Landscape) visualizes over 300 vendors and their products, organized into over 43 separate market segments rolled up into four major categories aligned to the student lifecycle.

Our mission at ACT® | NRCCUA® is to encourage higher education institutions to make more informed decisions. By providing data science and technology, we’ve helped over 2,000 institutions find and engage their best-fit students.

Toward this end, we’ve heard from many of our member institutions on how they’ve been able to achieve their goals through our research, technology, and solutions. We’ve compiled the Encoura Client Experience Collection to share their stories in the hopes that it will inspire and equip others to make more informed decisions, so that every student and institution can achieve their goals.