According to Eduventures Higher Education Technology Landscape (Landscape), 22% of edtech vendors offer edtech solutions and products in more than one technology segment, with some appearing in over 12 segments.

This statistic represents an increasingly common growth strategy: leveraging the implementation of one product, vendors look to extend their presence across the institution by offering new products to additional functional areas. Sometimes, vendors increase their product portfolios through mergers or acquisitions, such as the recent merger of Anthology and Blackboard. In other cases, they develop net-new products in adjacent areas such as retention, admissions, or data analytics.

But does this approach work?

Our Approach

To answer these questions, we isolated four vendors with the greatest representation in our Tech Landscape: Anthology, Oracle, Jenzabar, and Ellucian. We then leveraged active implementation data from our partners at LISTedTech across 3,200 institutions of all types— public, private, four-year, two-year, etc.—within the five segments where these vendors appeared. These five segments include Student Information Systems, Enterprise Business Intelligence and Analytics Solutions, Student Retention Solutions, Constituent Relationship Management (CRM) Solutions, and Advancement Constituent Relationship Management Solutions.

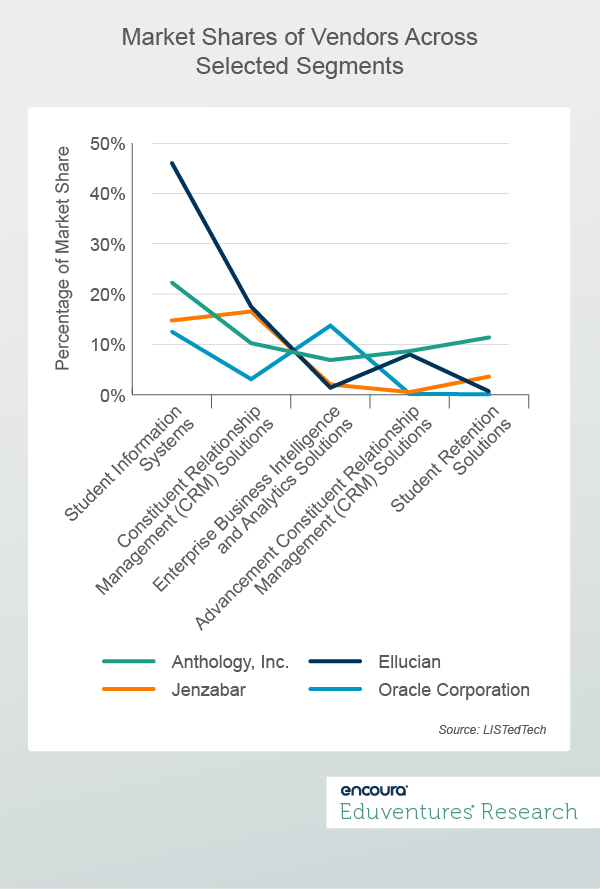

Figure 1 shows the overall market share of each of these four vendors across each of the five segments.

Figure 1 shows a lot of fluctuation of market shares across the segments for most vendors. For example, Ellucian's market shares range from its dominant position (46%) in the Student Information Systems market to a meager share in the Student Retention Solutions market (0.6%). Likewise, Jenzabar's market shares fluctuate, from a high of 16% in the Constituent Relationship Management Solutions segment to a 0.5% share of the Advancement Constituent Relationship Solutions market. Also, while Oracle leads in the Enterprise Business Intelligence and Analytics Solutions market (13%), it has very low shares of the Constituent Relationship Management (CRM) Solutions and Advancement Constituent Relationship Management Solutions markets, with 0.1% and 0.08%, respectively.

While Anthology is not the market leader in any of the four segments, its rankings in the four segments do not vary as much as Ellucian's or Jenzabar's. For example, Anthology's highest market share is in the Student Information Systems segment (22%) and the lowest percentage in the Enterprise Business Intelligence and Analytics Solutions segment (7%), a difference of only 15%.

In theory, adopting a horizontal strategy seems logical: as leaders become more accustomed to a product and tire of the idea of connecting disparate products across an ecosystem, they would be more likely to choose the path of least resistance and add another product from the same vendor to their ecosystems. But this data and analysis also provide a cautionary tale about adopting this strategy.

It shows, for example, that being #1 in a segment does not always matter. While Ellucian and Oracle are market leaders in two segments—Student Information Systems and Enterprise Business Intelligence and Analytics Solutions, respectively—they have not translated these leadership positions into dominance within other segments. Likewise, looking to mergers or acquisitions to increase implementations of products across these segments – as Anthology has done – may only result in a modest presence in each segment and not dominance in any one segment.

Also, this analysis shows that there is still a strong taste for point solutions. EAB's Student Success Management System, for example, has the largest share (44%) of the Student Retention Solutions market segment. These solutions aim to address a single, specific problem, in contrast to solutions that offer a one-stop-shop or modular approach or address many problems. This data suggests institutional leaders remain willing to take on the challenge of integrating these solutions with other solutions, such as Student Information Systems, perhaps with the help of the vendors themselves or by developing an integration strategy on their own.

The Bottom Line

Vendors choosing to adopt a horizontal strategy cannot rely on higher leaders to take the path of least resistance. They must continue to offer products that fit within their portfolios and offer functionality that competes with point solutions. Without including these considerations in their strategies, they risk having a product portfolio with mixed success in the market.

For institutional leaders, the key takeaway is that many institutions are resisting the lure of having one vendor manage across disparate systems and are mixing and matching solutions across their ecosystems. These leaders, therefore, should consider products offered by vendors with which they have existing relationships alongside point solutions, viewing both sets of products through the lens of meeting functional and strategic needs.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

Tuesday November 30, 2021 at 2PM ET/1PM CT

Institutions have increasingly focused on improving transfer student pathways to support them along their educational journeys—a focus heightened by the impact of the COVID-19 pandemic. Now transfer students are speaking out on what type of support they need from colleges when they are considering enrollment.

Research from Eduventures 2021 Transfer Student Survey™ focuses on the motivations, concerns, and search behaviors of two different types of transfer students: those who plan to transfer (prospective transfer students) and those who have already transferred from one school to another (retrospective transfer students). We further disaggregated this data by demographic subgroups such as first-generation status, gender, household income, and race/ethnicity. We then ranked their responses by frequency.

Our analysis points to a missing key piece in improving the transfer student pathway: the importance and role of the receiving institution. In this webinar, Eduventures Principal Analyst James Wiley will reveal key insights from the 2021 Transfer Student Survey that will equip receiving institutions with actionable data for improving transfer student pathways, including:

- The top concerns of prospective transfer students

- Areas where retrospective transfer students could have used more help

- How prospective and retrospective student subgroups vary in their concerns

- How to retain transfer students after they enroll

Eduventures® 2021 Higher Education Technology Landscape (Landscape) visualizes over 300 vendors and their products, organized into over 43 separate market segments rolled up into four major categories aligned to the student lifecycle.

Throughout the year, we analyze these vendors and products and make that content available to clients. Several vendors have multiple products in their education technology portfolios.