Have you ever peered into an expensive shop, looked at the sleek merchandise, realized you probably couldn’t afford anything, and left before the clerk could notice you? Have you ever walked past a discount store, reminded yourself not to waste money on an item that might fall apart before you get it home, and kept right on walking?

In both cases, you are making judgments without knowing the full story. As consumers, we want to feel just right about the product and the price. Of course, it’s one thing to apply consumer psychology to shoes or toasters. But when you are talking about the purchase of a college education, the consumer decision takes on an almost existential weight.

How does the psychology of price affect the early choices about which institutions a student will even engage with at the start of college search?

The world of college tuition is terrifying for a 17- or 18-year-old high school student. The list price tuition and fees students see as they enter their college search is the first glimpse of a great unknown they will untangle over the next few decades.

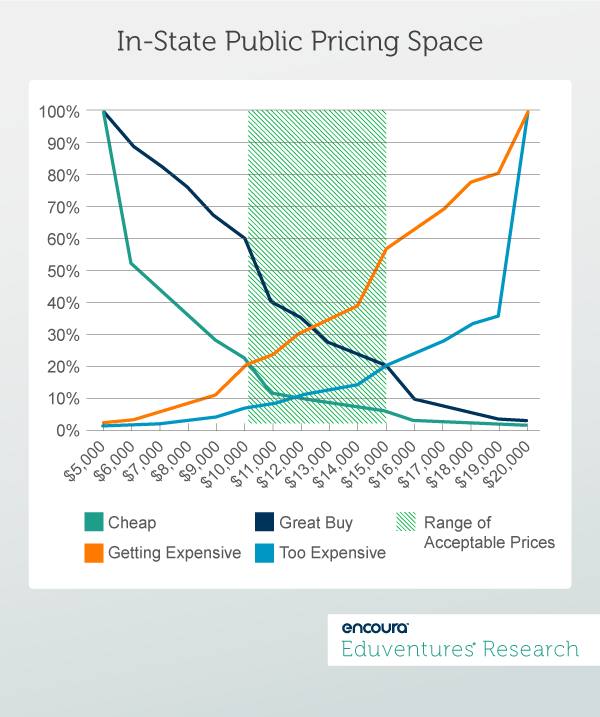

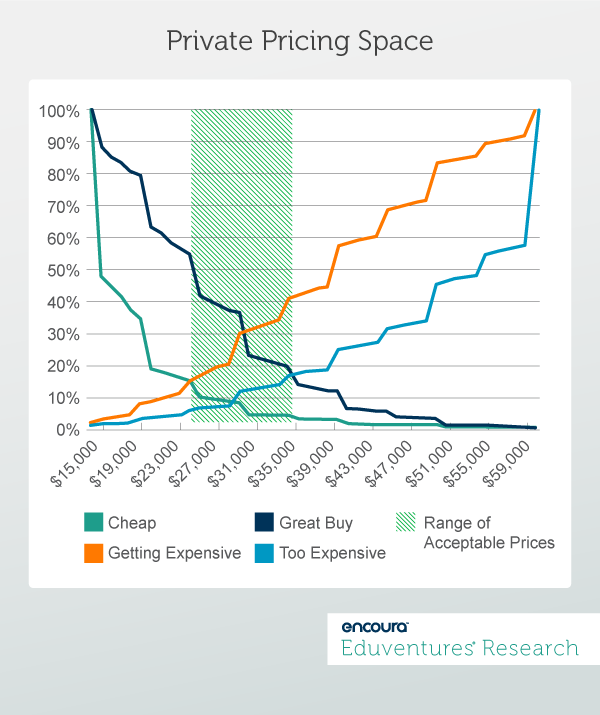

For private institutions, the news is not nearly as rosy. Students’ psychological pricing frameworks put the upper limit of acceptable tuition and fees, before they get too expensive to consider, at $36,000 per year. The optimal price point is $29,000.

For private institutions, the news is not nearly as rosy. Students’ psychological pricing frameworks put the upper limit of acceptable tuition and fees, before they get too expensive to consider, at $36,000 per year. The optimal price point is $29,000.

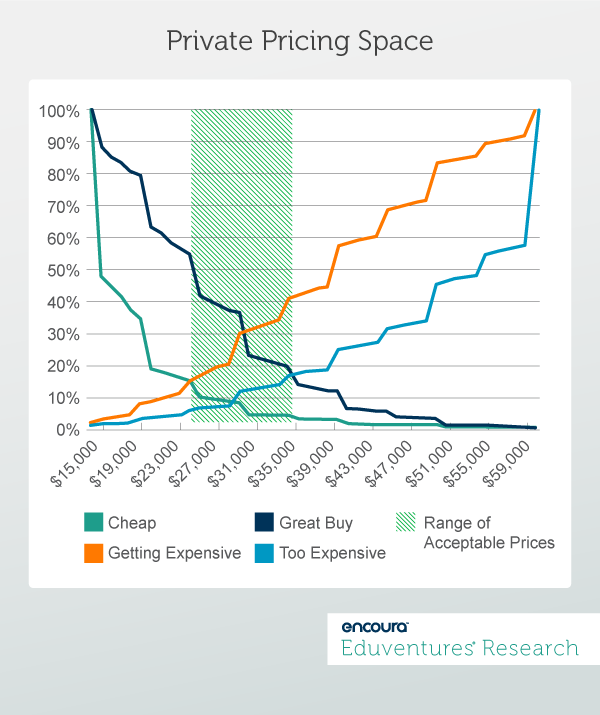

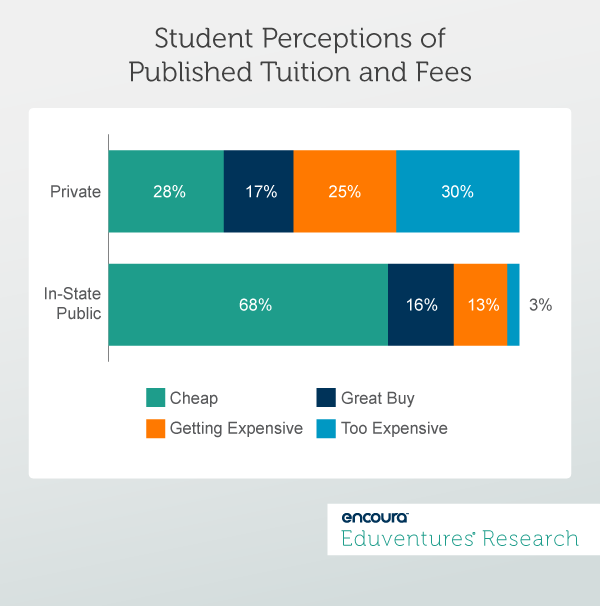

We can also compare students’ perceived notions of the college pricing space to actual published tuition and fees for the institutions they are considering applying to. This comparison highlights the challenges that institutions have in engaging students on the topic of sticker price and, eventually, net price, total price, and debt along the enrollment journey.

We can also compare students’ perceived notions of the college pricing space to actual published tuition and fees for the institutions they are considering applying to. This comparison highlights the challenges that institutions have in engaging students on the topic of sticker price and, eventually, net price, total price, and debt along the enrollment journey.

The good news is that only a small percentage of in-state students view sticker price tuition as a barrier to considering their public in-state institution. The relatively low prices they see and the over-saturated familiarity they have with their regional schools, however, might have some negative brand impact for high income, high academic profile students who are considering attending private or out-of-state institutions. This carries the risk that these students might bypass your institution for a perceived higher quality product. In order to retain high quality in-state students, public institutions must counter the psychology of the pricing frame with purposeful messages of quality and value.

Private institutions, however, face a tough road in aligning student pricing frameworks with the reality of the market. These schools must convince the nervous prospect shopping in that expensive boutique that the product may, in fact, be within reach. This is particularly true if the student is able to attend an elite private institution that is committed to low net costs and no or low student loans.

The challenge is that the marketplace does not widely understand these policies or opportunities early in the enrollment funnel. Eduventures’ research shows that prospective students, regardless of their demography, are unclear about the nature of the financial aid that might come their way. And, the 30% of institutions with tuition and fees outside students’ perceived acceptable range of pricing have reason to worry that students may not “come in to shop” in the first place.

To be clear, we don’t advocate that institutions necessarily alter their tuition. We do advocate that they adjust their marketing, communications, and outreach to ensure that more price-sensitive student populations enter the store.

The point is that the 17- or 18-year-old, at the application stage, has a psychological frame in mind about quality and price that underlies an unfolding learning process about the price of their education. This analysis reminds us that price and brand perception go hand-in-hand. Buying behavior will be motivated by the unconscious psychological response to this relationship rather than by any rational thought process, especially if students don’t have any information about the true price and the true value of your institution.

The good news is that only a small percentage of in-state students view sticker price tuition as a barrier to considering their public in-state institution. The relatively low prices they see and the over-saturated familiarity they have with their regional schools, however, might have some negative brand impact for high income, high academic profile students who are considering attending private or out-of-state institutions. This carries the risk that these students might bypass your institution for a perceived higher quality product. In order to retain high quality in-state students, public institutions must counter the psychology of the pricing frame with purposeful messages of quality and value.

Private institutions, however, face a tough road in aligning student pricing frameworks with the reality of the market. These schools must convince the nervous prospect shopping in that expensive boutique that the product may, in fact, be within reach. This is particularly true if the student is able to attend an elite private institution that is committed to low net costs and no or low student loans.

The challenge is that the marketplace does not widely understand these policies or opportunities early in the enrollment funnel. Eduventures’ research shows that prospective students, regardless of their demography, are unclear about the nature of the financial aid that might come their way. And, the 30% of institutions with tuition and fees outside students’ perceived acceptable range of pricing have reason to worry that students may not “come in to shop” in the first place.

To be clear, we don’t advocate that institutions necessarily alter their tuition. We do advocate that they adjust their marketing, communications, and outreach to ensure that more price-sensitive student populations enter the store.

The point is that the 17- or 18-year-old, at the application stage, has a psychological frame in mind about quality and price that underlies an unfolding learning process about the price of their education. This analysis reminds us that price and brand perception go hand-in-hand. Buying behavior will be motivated by the unconscious psychological response to this relationship rather than by any rational thought process, especially if students don’t have any information about the true price and the true value of your institution.

How much is my college education going to cost me in the end?

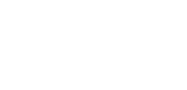

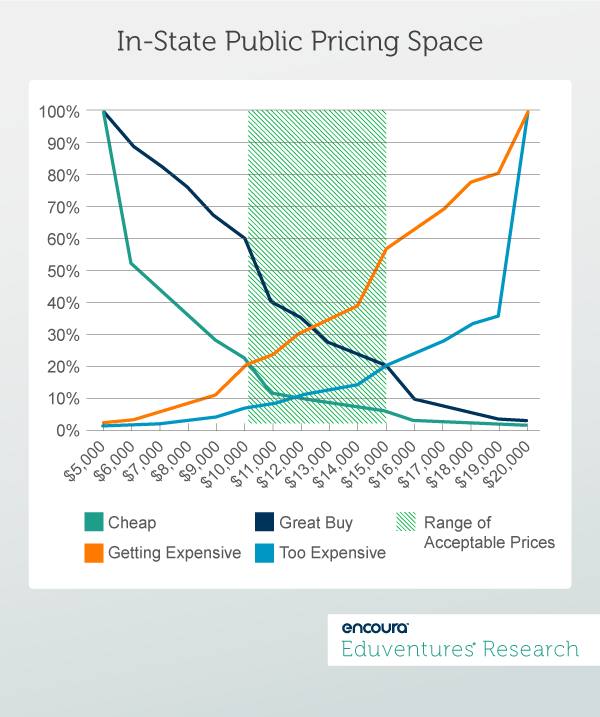

From their first glimpse at the list price for tuition and fees, students make judgements relative to their psychological frames of reference. Conversations with family and friends, discussions with college counselors, the news, and social media then shape ideas about what is cheap, a good buy, a fair price, or just too expensive. Eduventures 2018 Prospective Student Survey sought to understand college-bound high school students’ perceptions of listed tuition and fees. We asked students to identify the price at which they’d begin to question the college’s quality. We also asked the price at which they would consider the college to be a good buy, getting expensive, and too expensive to consider (we have similar data on prospective adult learners, but we’ll save that for another post). So, did students’ psychological pricing space match the actual pricing space of the institutions they are considering? If there is a mismatch, what are the ramifications for recruiting students? At first glance, the chart below shows good news for public institutions. Students put the acceptable price range for in-state public schools at $10,000 -$15,000 per year in tuition and fees before grants and scholarships. The optimal price point—the point at which an institution is neither too cheap nor too expensive—would be about $12,000, and begins to tip over into expensive at $13,000. For private institutions, the news is not nearly as rosy. Students’ psychological pricing frameworks put the upper limit of acceptable tuition and fees, before they get too expensive to consider, at $36,000 per year. The optimal price point is $29,000.

For private institutions, the news is not nearly as rosy. Students’ psychological pricing frameworks put the upper limit of acceptable tuition and fees, before they get too expensive to consider, at $36,000 per year. The optimal price point is $29,000.

We can also compare students’ perceived notions of the college pricing space to actual published tuition and fees for the institutions they are considering applying to. This comparison highlights the challenges that institutions have in engaging students on the topic of sticker price and, eventually, net price, total price, and debt along the enrollment journey.

We can also compare students’ perceived notions of the college pricing space to actual published tuition and fees for the institutions they are considering applying to. This comparison highlights the challenges that institutions have in engaging students on the topic of sticker price and, eventually, net price, total price, and debt along the enrollment journey.

The good news is that only a small percentage of in-state students view sticker price tuition as a barrier to considering their public in-state institution. The relatively low prices they see and the over-saturated familiarity they have with their regional schools, however, might have some negative brand impact for high income, high academic profile students who are considering attending private or out-of-state institutions. This carries the risk that these students might bypass your institution for a perceived higher quality product. In order to retain high quality in-state students, public institutions must counter the psychology of the pricing frame with purposeful messages of quality and value.

Private institutions, however, face a tough road in aligning student pricing frameworks with the reality of the market. These schools must convince the nervous prospect shopping in that expensive boutique that the product may, in fact, be within reach. This is particularly true if the student is able to attend an elite private institution that is committed to low net costs and no or low student loans.

The challenge is that the marketplace does not widely understand these policies or opportunities early in the enrollment funnel. Eduventures’ research shows that prospective students, regardless of their demography, are unclear about the nature of the financial aid that might come their way. And, the 30% of institutions with tuition and fees outside students’ perceived acceptable range of pricing have reason to worry that students may not “come in to shop” in the first place.

To be clear, we don’t advocate that institutions necessarily alter their tuition. We do advocate that they adjust their marketing, communications, and outreach to ensure that more price-sensitive student populations enter the store.

The point is that the 17- or 18-year-old, at the application stage, has a psychological frame in mind about quality and price that underlies an unfolding learning process about the price of their education. This analysis reminds us that price and brand perception go hand-in-hand. Buying behavior will be motivated by the unconscious psychological response to this relationship rather than by any rational thought process, especially if students don’t have any information about the true price and the true value of your institution.

The good news is that only a small percentage of in-state students view sticker price tuition as a barrier to considering their public in-state institution. The relatively low prices they see and the over-saturated familiarity they have with their regional schools, however, might have some negative brand impact for high income, high academic profile students who are considering attending private or out-of-state institutions. This carries the risk that these students might bypass your institution for a perceived higher quality product. In order to retain high quality in-state students, public institutions must counter the psychology of the pricing frame with purposeful messages of quality and value.

Private institutions, however, face a tough road in aligning student pricing frameworks with the reality of the market. These schools must convince the nervous prospect shopping in that expensive boutique that the product may, in fact, be within reach. This is particularly true if the student is able to attend an elite private institution that is committed to low net costs and no or low student loans.

The challenge is that the marketplace does not widely understand these policies or opportunities early in the enrollment funnel. Eduventures’ research shows that prospective students, regardless of their demography, are unclear about the nature of the financial aid that might come their way. And, the 30% of institutions with tuition and fees outside students’ perceived acceptable range of pricing have reason to worry that students may not “come in to shop” in the first place.

To be clear, we don’t advocate that institutions necessarily alter their tuition. We do advocate that they adjust their marketing, communications, and outreach to ensure that more price-sensitive student populations enter the store.

The point is that the 17- or 18-year-old, at the application stage, has a psychological frame in mind about quality and price that underlies an unfolding learning process about the price of their education. This analysis reminds us that price and brand perception go hand-in-hand. Buying behavior will be motivated by the unconscious psychological response to this relationship rather than by any rational thought process, especially if students don’t have any information about the true price and the true value of your institution.