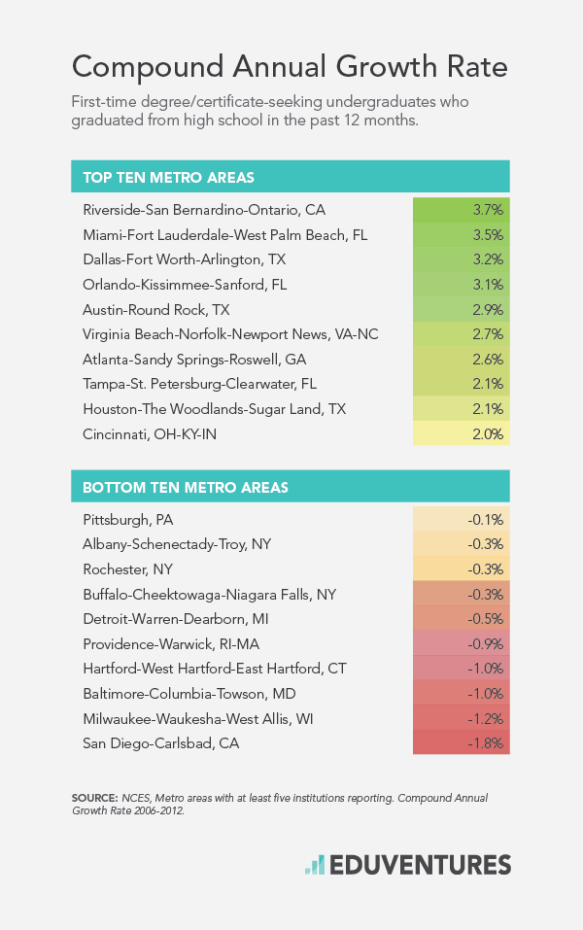

Colleges and universities that serve traditional undergraduates are facing a diminishing addressable market in certain parts of the country, particularly the Northeast and Midwest. While these institutions are making every effort to optimize access to these markets, as well as developing alternative enrollment streams, there are undeniably limited opportunities for enrollment growth. In the face of this reality, Eduventures urges institutions to think about the appropriate role of growth in overall institutional strategy. Is growth feasible and, if so, how?

Predicted Regional Declines In Traditional Undergraduates Have Set In

NACAC’s recently released list of selective-admissions member colleges that still have openings for the fall makes clear the continuing demographic challenges in undergraduate education for traditional-aged students. With 220 institutions on the list, some areas of the country seem to be experiencing enrollment troubles more acutely than others. Eduventures estimates that 44% of four-year NACAC member institutions in Ohio and 38% of those in Illinois reported available openings for fall admission. This corroborates the 2012 WICHE report, “Knocking at the College Door,” which predicted there would be a “sharply reduced number of high school graduates” in Illinois and Ohio. The data in this report also showed that:- There will not be a return to growth for college-bound high school seniors until 2022.

- When the growth returns, institutions will be serving a demographically different audience that will be more diverse and in greater need of financial assistance.

Institutions Have Done All They Can to Optimize a Diminishing Market

These trends have given rise to unrealistic expectations for growth, evoking angst among many enrollment leaders. Institutions have set enrollment targets to backfill lost or diminishing domestic traditional-aged enrollment, including getting in the hunt for international students and beefing up transfer recruitment. Institutions that rely on traditional undergraduates for a great deal of their revenue are also examining graduate and non-traditional enrollments as they consider an all-encompassing enrollment strategy to maintain institutional health in changing times. In terms of domestic undergraduate enrollments, however, colleges have been converting higher numbers of a shrinking addressable market to meet growth targets. They have been sailing into a headwind using many tactics to eke out growth over the last few years. These include: sharpening recruiting and retention practices, evaluating the student experience, branding and positioning, gathering and disseminating information on outcomes, redefining a value proposition, optimizing financial aid to meet enrollment goals, and revisiting academic program portfolios. Eduventures recommends that institutions in regions with smaller addressable markets of traditional undergraduates pursue some combination of three pathways:- Gain market share by sharpening their competitive position within the market.

- Invest in the development of emerging geographic markets beyond their region.

- Right size within a realistic set of enrollment expectations.

A Realistic Understanding of Growth Opportunities

Let’s be realistic and responsible about options for growth. The numbers tell us that the market for traditional undergraduates is tight. The viability of non-traditional markets is even questionable. The verdict is that continued enrollment growth isn’t necessarily a realistic strategy for all institutions. As you engage with the question of sustaining or growing healthy enrollment, ask bigger questions about overall institutional strategy:- What is the role of your institution in your community and region?

- Is growth a realistic strategy to meet the mission?

- Should your institution right size to meet the mission?

- What is the enrollment mix that will meet the mission?