In August, President Biden announced unprecedented plans to forgive a big chunk of federal student loan debt—an estimated 45% of borrowers will be debt free—prompting heated debate about plan details, who stands to benefit, impact on public finances, and even the legality of the move. (The plan is currently suspended while various legal challenges are sorted out, but borrowers are still encouraged to apply- and 26 million have already done so).

Canceling student debt might signal that college is a poor value-for-the-money, cooling enrollment interest. In today’s market, that is the last thing institutions need. Alternatively, Biden’s plan, along with a commitment to expand income-based repayment and public service forgiveness programs, might make enrollment seem a better financial bet.

There is a lot riding on which view is the right one.

Cancel Student Debt Now?

Casual observers might scratch their heads about the timing of Biden’s announcement. From one perspective, 2022 is not a period of particularly acute loan distress. The number of borrowers is flat, repayment rates are stable, and interest and repayments have been suspended since the early days of the pandemic. Covid stimulus, low unemployment, a worker shortage, and net wage gains suggest, that for many Americans, 2022 might be a good time to repay their student loans.

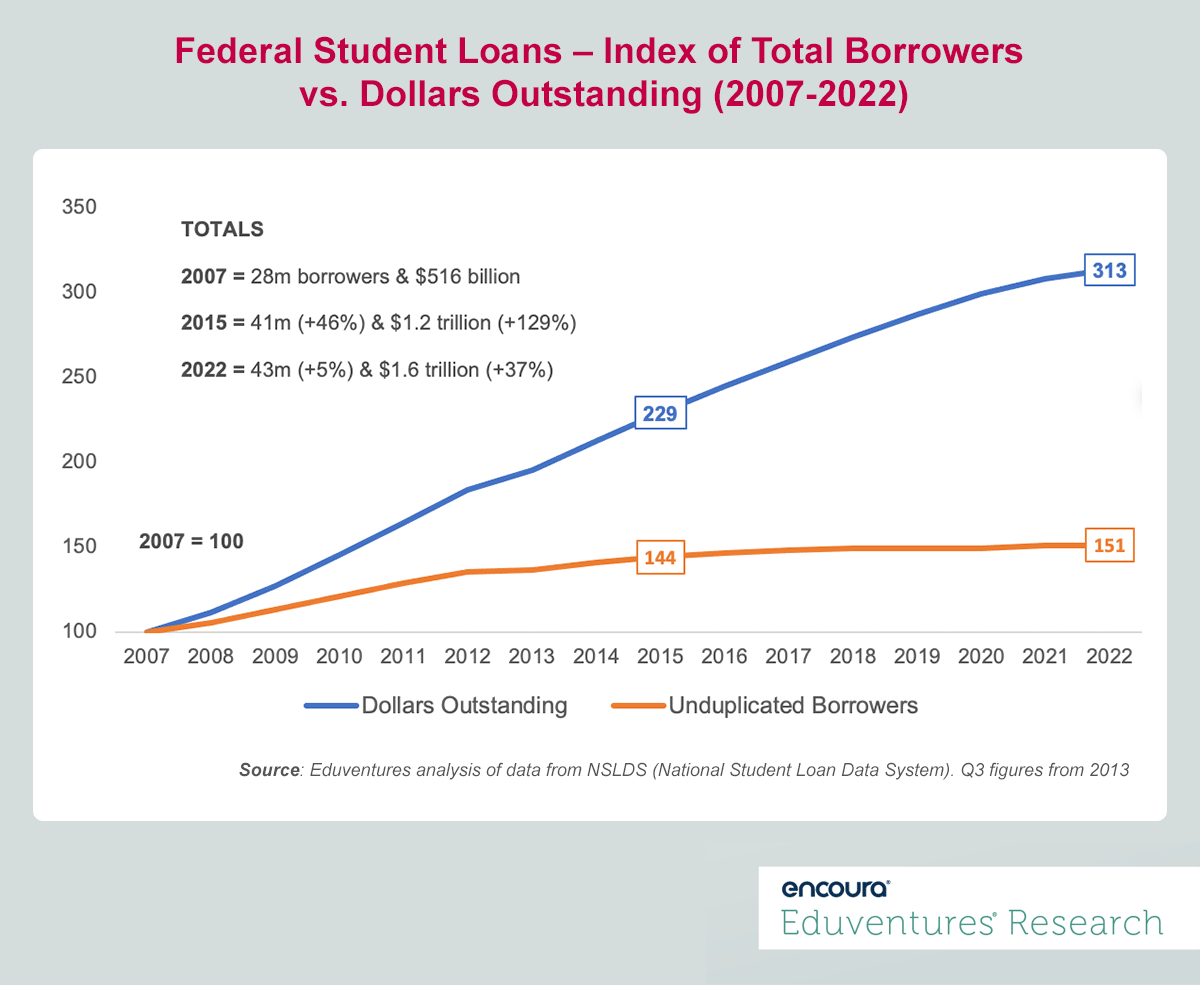

This ignores the sheer size of the debt pile. Figure 1, contrasting growth in the number of federal student loan borrowers with dollars outstanding, makes the problem clear: while borrower numbers have flatlined, total student loan debt has more than tripled since 2007.

Figure 1

But Figure 1 is not simply a story of tuition hikes and student distress.

A peaking age cohort among high school graduates is one reason borrower numbers have slowed in recent years. Also, the loan portfolio has skewed more graduate over the past decade, helped by age cohort size and growth in bachelor’s attainment. Many graduate students are ineligible for institutional or state subsidies, and (post-2006) there has been no cap on the amount a graduate student may borrow from the federal government to pay for school. The Obama-era loan reforms generally reduced borrowing costs for students and widened forgiveness options.

Counterintuitively, there is a correlation between higher income and student debt. According to the latest Federal Reserve’s Survey of Consumer Finances (2019), 58% of outstanding student loan debt and 73% of monthly debt repayments fall in households in the top two income quintiles. As college tuition has risen, better off families have borrowed more, at undergraduate and graduate levels.

Yes, the non-repayment rate (deferment, forbearance, and default combined) has been remarkably steady over the past decade at about 40% of borrowers and dollars. But the fact that the non-repayment rate held up even as total loans outstanding expanded dramatically—never mind the obvious that a 40% non-repayment rate suggests a serious mismatch between debt and value—helps explain Biden’s action.

In short, most borrowers have achieved decent ROI and have been able to repay their loans, but a large minority, many with modest balances who did not complete a degree, have faced difficulties.

Biden acted to fulfill a campaign promise ahead of the mid-term elections, and rising interest rates mean higher government borrowing costs that will be passed on to borrowers once repayments resume in January. At the same time, higher inflation will shrink the value of student debt.

Does the President Want Me to Enroll or Not?

In his speech announcing the forgiveness plan, President Biden stressed that an educated citizenry is vital for the nation’s future. He cited America’s investment in universal high school as pivotal to the country’s 20th century preeminence. But he argued that college costs today, which have outstripped wage growth for decades, were squashing the potential of millions of Americans.

The president blamed states for inadequate funding, congress for being parsimonious on Pell, and institutions for fielding too many programs that offer a poor return. Many borrowers never complete a degree, he continued, and student debt meant that many young people could not get a mortgage and were delaying starting a family.

The president supports college enrollment but has limited room for maneuver. Only Congress can fund Pell and states, not the federal government, determine spending on institutional operations.

Loan forgiveness aside (up to $10,000—$20,000 for Pell recipients—per borrower earning up to $125,000, twice that for couples), Biden pledges to revamp income-based repayment and public service forgiveness programs, making debts more manageable. To curb dodgy college programs, the president is relying on a revived Gainful Employment regulation coming into force in 2024.

On college costs, Biden has nothing. With his Free Community College plan dead in the water, and congress unlikely to agree to a new funding compact any time soon, mass debt forgiveness is the president’s best option to tackle college affordability, if only post-enrollment. Nobody seems keen to cap graduate student borrowing.

Biden’s forgiveness plan is estimated to cost some $400 billion over time. Spending that money on grants to less well-off current and future students would offer more direct purchase on college affordability but is beyond the scope of an executive order.

The Bottom Line

Assuming legal roadblocks are overcome, only time will tell how Biden’s debt jubilee shapes future college enrollment. If new-and-improved income-based repayment and public service forgiveness programs are well-publicized and function effectively, then college enrollment may get a boost. If the College Scorecard is used by more prospects to pick “better” programs, that will help, too.

All schools are subject to Gainful Employment reporting and nonprofits will have to submit data on all programs, but they will not be penalized. But if nonprofit schools wriggle out of Gainful and the administration of repayment shortcuts is botched, the public mood will sour. Future students and alumni, seeing the debt burden surpass today’s heights, will ask why they do not deserve loan forgiveness. Today’s forgiveness may fuel inflation, adding to pressure on colleges to raise tuition.

Regardless, the fact that the borrowers who will benefit most from forgiveness—those in low paid work with small balances, many without a degree—sends a clear signal that college enrollment is not always what it seems. That can only give some prospects pause. For the better off, a lingering sense that college is losing value relative to price is not sustainable.

Colleges are using technology to lower costs. Online degrees help students combine work and study. The cluster of low-price degrees offered through Coursera and edX goes a step further. More of this needs to happen if colleges are to truly address the cost-value problem in higher education. But the thorny question remains whether such online innovations are the best way to serve the nontraditional students Biden plans to bailout. Creative hybrids of campus and online are a better bet, but still on the drawing board. For good or ill, inexpensive degree alternatives are bound to gain ground, which will help concentrate the minds of college leaders.

President Biden’s student loan forgiveness plan is a dramatic intervention in a complicated situation. Joe wants more people to enroll in college and is praying that his big policy gamble does not end up having the opposite effect.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model

Thursday, November 10, 2022 at 2pm ET/ 1pm CT

This webinar will present parent and student price sensitivity data that explores this question. We’ll also examine the changing landscape of institutions that have initiated tuition price resets. Join us as we discuss how to understand what best-in-class tuition models will look like in the future and what practical steps institutions can take now toward that end.