11,000 jobs cut at Meta. 10,000 at Amazon. 4,000 at Carvana. 8,000 at Salesforce. And, most recently, 10,000 jobs at Microsoft – its largest layoff in eight years. The list goes on. After years of strong growth and a particularly explosive hiring boom for many firms during the pandemic, technology-enabled companies have stumbled, announcing, in some cases, significant layoffs.

A slowing economy, high inflation, and high interest rates have driven many companies to cut expenses in preparation for a potentially rocky road ahead – a stark contrast to the prior decade when money was cheap, and growth was prioritized over profit.

Blast from the Past

If the past is any indicator, the duration and severity of high interest rates and recession fears will be telling. These are often pointed to when dissecting the dot-com bubble burst in 2000 – when aggressive investment led to the overvaluation and subsequent crash of the nascent internet/technology industry. In the two years following, computer and mathematical occupations declined by 4% outpacing all job losses over that period (-1%).

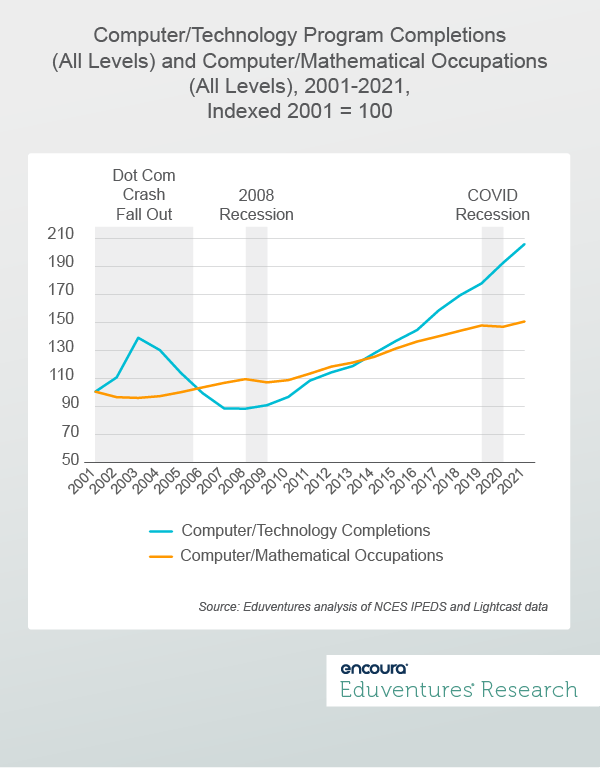

Aligned academic program completion trends followed suit. From a peak, at that time, of 171,274 completions in 2003, the computer/technology credential market contracted by 36% to just over 109,000 completions across all levels in 2007. As computer and mathematical occupations recovered and then grew again, so too did computer/technology program completions.

Figure 1 tracks both trends over the last two decades.

The Great Recession from 2008-2009 had less of an impact on computer and mathematical occupations than the dot-com crash. While all occupations declined by 5% between 2008 and 2010, computer and mathematical jobs declined by only 1%. The brief COVID-19 recession saw the same trend play out. While all jobs declined by 6% between 2019 and 2020, computer and mathematical jobs declined by only 1%.

Notably, the aligned credential market did not crash following the Great Recession as it did during the dot-com bubble fallout. Since 2011, both aligned occupations and completions saw mostly steady growth, by 33% and 90% respectively, with occupations nearing five million and completions topping 250,000 in 2021. Of note, technology occupations quickly rebounded in each year following the last two recessions on record.

Based on these historic trends, a brief recession spread across industries—rather than hyper-specific like the dot-com crash—does not indicate a long-term negative impact on the computer and mathematical-aligned labor market. Additionally, signs point to the likelihood of sustained growth within the aligned academic program market. Some key nuances, detailed next, help support this theory.

Some Nuances

While headlines certainly spell doom and gloom for the technology sector, and students studying in aligned fields, there are some important nuances in the details to consider when trying to forecast how the aligned program market may be affected.

- Too Much Growth Too Quickly? Many of the technology companies slashing jobs today are the same ones that rapidly expanded their headcounts over the pandemic period—perhaps too quickly. Coming out of the pandemic, many companies appear to be in a phase of rightsizing as opposed to freefall. For example:

- Meta’s 11,000 job cut is a 13% decrease, but this is just half of the 28% headcount growth it saw over the last year alone.

- Robinhood, the online stock brokerage that saw its userbase surge during the market highs of the pandemic, announced a headcount reduction of 23% in August. Between 2020 and 2021, its headcount grew from 700 to about 3,800.

- Salesforce announced a 10% cut earlier this month, equating to a cut of about 8,000 employees based on a December headcount of 79,000. To put this in context, Salesforce employed only 49,000 people in January 2020 just before the pandemic.

- The COVID Rebalance. As much as the changes that COVID-19 brought to everyday life in 2020 were a shock, the snap back to a pre-COVID “normal” was just as shocking for some companies. As COVID-19 subsides, more people appear to be looking for a balance of online and in-person experiences. For example:

- Peloton experienced explosive adoption of its at-home fitness equipment and technology in the early days of the pandemic, but announced a third wave of layoffs in August as the bet on sustained at-home workout adoption cooled.

- Shopify, an online store technology provider, recently reduced its global headcount by 10%, but it had doubled its headcount between 2020 and 2022 when many stores had to enhance their digital capabilities.

- Carvana, the online used car dealer, grew quickly during the pandemic when buyers looked beyond physical dealerships to find a car, but a used car supply crunch and rising prices reversed its path leading to a new round of layoffs in November.

- Not Just Technology Roles. Not all layoffs at technology-enabled companies solely affect technology-specific roles. In fact, for many of these firms, recruiting teams are often hit hardest due to reduced hiring planned for the immediate future. In many cases, technology-aligned positions supporting core products at these companies have been less affected. For example:

- Amazon, according to reports, may be laying off employees in its retail and human resource divisions along with its device’s organizations (think Alexa and Fire Tablets) while it refocuses on its core pillars of ecommerce and AWS.

- Meta’s planned layoffs, similarly, will stretch across divisions, from metaverse to Reality Labs. But reports say that some teams, like recruiting, will be hit harder than others.

- Stripe also announced its recruiting teams would be hit hardest.

The Bottom Line

Market signals suggest that the technology program market will not crash as it did after the 2000 tech bubble. For one, prospective student interest in technology aligned programming only strengthened through the pandemic period. In 2019, 4.2% of traditional aged college prospects showed interest in computer science and aligned programs making this the sixth ranked field of study. In 2022, this rose to 7% (seeing growth in both 2020 and 2021) coming in as the fourth highest-rated field of study.

Additionally, the technology sector is much more mature today than in the early 2000’s, and technology is more engrained in our lives than it was then. Many companies still report critical IT skills gaps and comment on the competitive nature of finding talent for these roles. Looking to the future, while all jobs are projected to grow by 9% over the next decade, computer and mathematical occupations are projected to grow by 16%, signaling above-average growth in the sector will still be the norm. Based on the last two economic downturns, evidence suggests a faster-than-average recovery for aligned professionals.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Thursday, November 10th, 2022 at 2pm ET/ 1pm CT

This webinar will present parent and student price sensitivity data that explores this question. We’ll also examine the changing landscape of institutions that have initiated tuition price resets. Join us as we discuss how to understand what best-in-class tuition models will look like in the future and what practical steps institutions can take now toward that end.

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.