According to a Wall Street Journal-NORC poll, more than half of Americans do not believe a four-year college degree is worth the cost. New America research reveals that 45% of Gen Z students believe a high school diploma is the minimum level of education needed to ensure financial security compared to 38% of Millennials, and 28% of Gen X.

Combined, these data points paint a bleak picture about perceived value in higher education. Indeed, the immediate college going rate of high school completers dropped by seven percentage points in four years, from 69% in 2018 to 62% in 2021— driven in large part by enrollment declines at two-year schools.

But the current value conversation is often missing a key element: what actual degree holders think.

Everything is Terrible, but I’m Fine

One way to explain the current mood is the “everything is terrible, but I’m fine” phenomenon – a mentality where people are optimistic when it comes to the individual but pessimistic when it comes to society. Derek Thompson, the author of an Atlantic article on the topic, used a finding from the Federal Reserve’s 2021 Survey of Household Economics and Decision-Making (SHED) to help illustrate this philosophy in practice. SHED asks respondents to assess three levels of economic health: their own financial well-being, the strength of the local economy, and the strength of the national economy. The study found that 78% of respondents reported doing at least okay financially, but only 48% said their local economy was good or excellent, and just 24% of respondents said the same about the national economy. Notice that the broader the scope, the more negative the response. A similar phenomenon is observed in some of Gallup’s most recent research on K-12 education satisfaction. In 2023, just 36% of U.S. adults reported being somewhat or completely satisfied with the quality of K-12 education. When responses from parents of K-12 students are isolated, however, the level of satisfaction more than doubled to 76%. In other words, parents without children in school are driving the non-satisfaction measurement. Is the same mentality spreading in higher education?The Higher Education Paradox

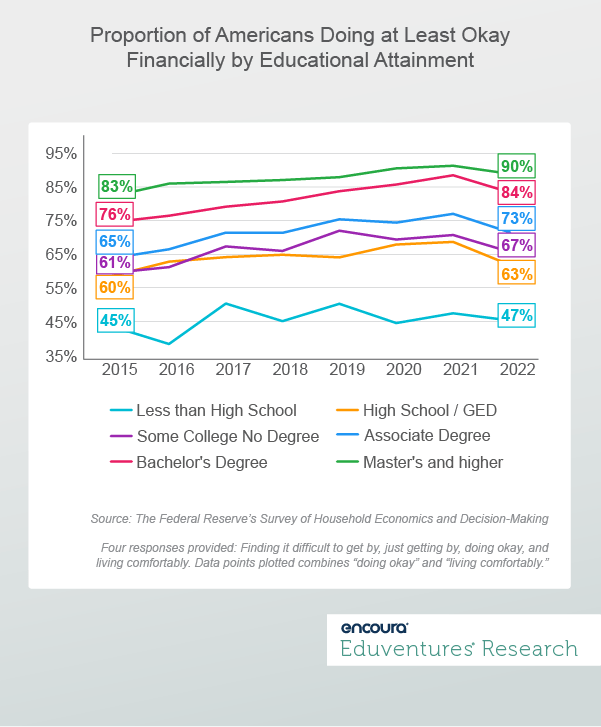

The data shows that the societal outlook on higher education is clearly moving in the wrong direction, but those who’ve gone through it have a different perspective. It is well documented that median lifetime earnings are correlated to educational attainment. Bachelor’s degree holders still outearn those with a high school diploma by more than one million dollars—the college wage premium in action. Self-reported individual financial well-being is also clearly associated with educational attainment levels. As shown in Figure 1, the higher one’s level of education, the better one’s financial well-being.

Taking Action

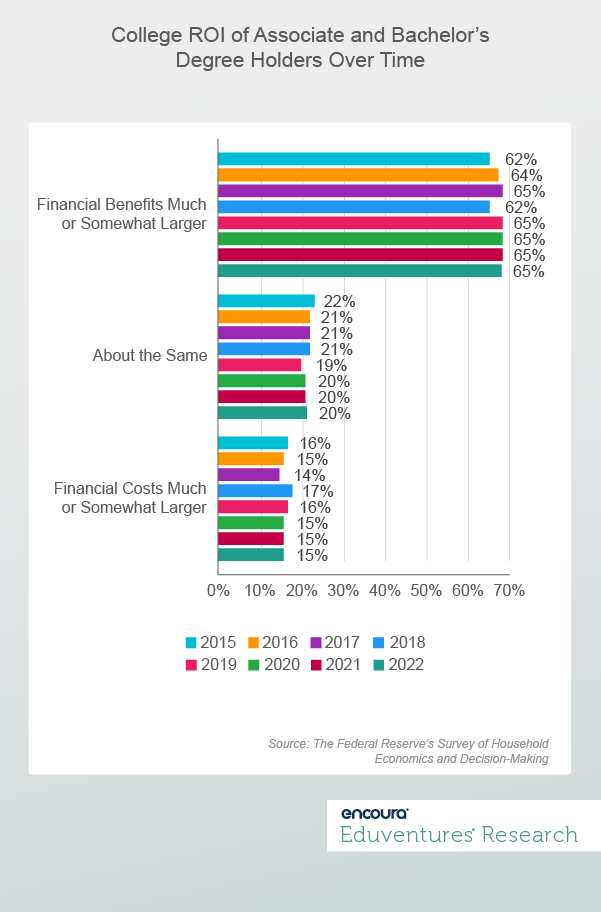

While the college wage premium remains intact and completer sentiment around ROI appears stable, the college wealth premium (a measurement taking both assets and debts into account—not just earnings) tells a different story. In fact, analysis from the Federal Reserve Bank of St. Louis reveals the college wealth premium is at historic lows for those born in and after the 1980s. Additionally, these statistics don’t consider the perspective of the sizeable number of Americans who attended college but did not complete their degrees, often leaving with debt but nothing to show for it—a real risk for many. This means that having a good story to tell might not be enough to combat the steady drumbeat of negative press. Many colleges will need to double down on innovation to address both price concerns (either real or perceived) and outcomes thereby strengthening their value. Here’s how some schools are doing it:- The three-year bachelor’s degree. Earlier this month, Brigham Young University Idaho and Ensign College made a splash as the first schools to offer accredited three-year bachelor’s programs. These are not accelerated programs condensing 120 credits into three years, rather, these are truncated programs requiring 90-94 credits at the expense of electives. These truncated programs will save students time and money and will likely be easier for schools to implement at scale compared to competency-based education initiatives, which come with significant implementation challenges.

- New points of entry. Universal Learner Courses have allowed Arizona State University (ASU) to unbundle its general education portfolio for high school students, those taking a gap year, and adult learners either looking for some credit or admission to ASU. Students enroll in a course for $25, and, if they pass, pay just $400 more for the academic credits. Credits can be rolled up to gain admission or achieve mastery certificates that align to specific skills and jobs. This initiative offers students college-level academic experience at a very low price point, allowing them to deepen their academic preparations and explore their routes to a degree.

- Pathway partnerships. We’ve written extensively about the rise of alternative providers as a threat to traditional higher education, but what do potential partnerships between the two look like? Northeastern University has multiple partnerships designed to turn alternative education experiences into college credit. Its bachelor’s degree completion program partnership with Coding Dojo allows students to turn their Coding Dojo experiences into 18 credits to be applied to a Bachelor’s in Information Technology. This saves $9,000 in earned credits and opens a pathway to scholarships worth another $15,000.

The Bottom Line

Colleges and universities still have a powerful story to tell, but this can be drowned out by the latest data points or headlines crafted to challenge that notion. Colleges and universities need to recognize the clear tension of rising costs, both real and perceived, amid stagnating outcomes (i.e., completion rates). We’ve said it before, colleges need to show, not tell, prospects their successes. A recent Wake-Up Call on this topic provides a check list of questions to help inform a school’s messaging strategy on the value equation and highlights the need for customized messages on value based on student segments. In other words, this is not a one-size-fits-all issue. Schools that make efforts to reinforce their value messaging and take real action in relieving cost burdens for prospects will find themselves in the best position to combat the ever-louder drumbeat of the declining value narrative.Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.