Once again, income-sharing agreements (ISA) are in the wind.

They’ve become the darling of many software coding bootcamps such as Lambda School, which recently attracted $150,000,000 of venture capital from a raft of Silicon Valley investors and even Ashton Kutcher. At the same time, a flurry of legislative attention from both Congress and several states signals renewed interest in the ISA.

By waiving tuition and instead recouping a percentage of graduate’s earnings over time, to our current student debt crisis. Critics argue that ISAs are simply a “gateway drug to predatory lending,” nothing more than consumer protection taking a backseat to innovation.

Although the number of ISAs in use is small, we think it’s worth taking a moment to remember where they came from, how they are used today, and what their future might hold for higher education.

The Origins of the ISA

The ISA is not a new concept. The ancestor of the ISA was the human capital contract, conceived by Milton Friedman in the 1950s. Friedman envisioned schools buying "a share of an individual’s earning prospects to advance him the funds needed to finance his training on condition that he agrees to pay back the lender a specified fraction of his future earnings.”

Public colleges and universities in Australia have operated a version of the human capital contract for decades. Graduates from Australian public institutions repay their tuition only after their annual income exceeds $35,000, and then at a rate indexed between 4% and 8% based on their earnings.

Some U.S. schools, notably Yale University in the 1970s, experimented with human capital contracts, but the predominance and easy availability of federal student aid tamped down institutional tolerance of the ISA.

The ISA Spectrum: From Bootcamps to Purdue

Today, ISAs can be found at opposite ends of the higher education spectrum. Non-degree providers, such as coding bootcamps, seek students who need not rely on federal aid. These providers either offer their own ISAs or partner with a third party funder.

Lambda School, with more than 1,000 students under ISA agreements, asks graduates to pay 17% of their income for 24 months, capped at a total of $30,000. Before Lambda School emerged in 2017, a flurry of these start-ups began offering alternative funding models in the early 2000s, including ISAs, to both bootcamp and degree-seeking students. Several ended up in bankruptcy court and epitomized the danger of an unregulated alternative financial aid marketplace.

At the other end of the spectrum, colleges and universities are taking a second look at the ISA, largely as a means to supplement or “top off” other federally-regulated forms of aid. These ISA-friendly schools are attempting to carve out a middle ground between their ability to provide access to federal aid and a pay-as-you-earn appeal of an ISA.

Among these schools, the ISA is backed by either a private third party, or its own managed fund. Vemo Education has emerged as a leading provider of ISAs to schools including Norwich University, Clarkson University, Colorado Mountain College, Lackawanna College, and the University of Utah. Another provider, albeit smaller, is MentorWorks, which embeds ISA agreements within a cluster of supplemental career and mentoring services provided free to the student.

Purdue University’s "Back a Boiler" is the most developed and well-known institution-based ISA. Now in its fourth year, Back a Boiler has issued 759 contracts to third- and fourth-year undergraduates, with a value of $9.5 million. Purdue has capped the amount of ISA debt its graduates can accumulate at no more than 15% of their annual incomes.

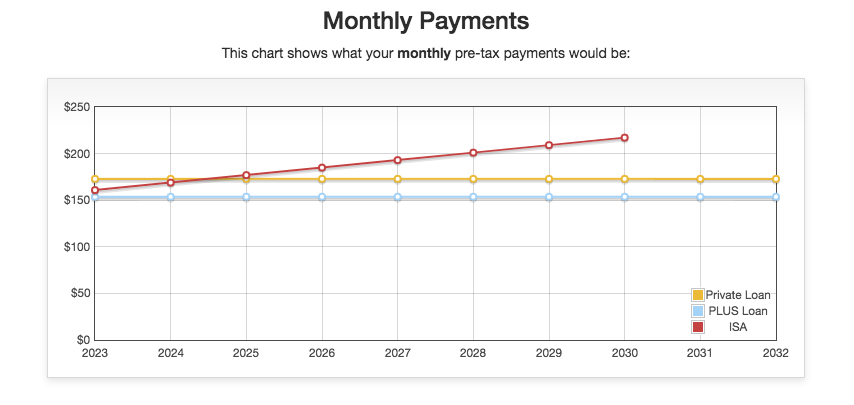

Purdue offers a significant level of transparency for students seeking to compare an ISA with conventional loans: the Back a Boiler website. For example, a mechanical-engineering student, graduating in 2022 and seeking a $9,000 ISA, would have lower payments that increase as income grows (Figure 1).

Source: Purdue University Back a Boiler Comparison Tool

Purdue’s President (and upcoming keynote speaker at Eduventures’ 2019 Higher Ed Summit, June 5-7), Mitch Daniels, anticipates that Back a Boiler will be a means to “help students launch their lives with less debt and greater financial security.” The ISA proof-of-concept will be determined when a critical mass of these Purdue alumni enter the job market and complete their repayment commitments.

The ISA 2.0

Which way will the ISA winds blow? An interesting question is whether institutions will offer ISAs as either a “top-off” financial aid solution, or a replacement for federal aid altogether. As ISA critics and advocates tussle over its future, several key questions need to be answered:

- Will ISAs close or widen income gaps experienced by access populations? Will under-resourced students with poor credit histories entering fields with nominal entry incomes, be unfairly penalized? Or would an ISA enable them to eliminate an education debt earlier?

- How might the long overdue reauthorization of the Higher Education Act (HEA) impact ISAs? Or will the states step up and offer ISAs, and if so, will these be consistently regulated?

- What level of oversight will be appropriate for independent ISA providers, such as Vemo and Lambda? Can these providers adequately balance their innovations with consumer fraud protections?

The current ISA climate is best illustrated by a new organization, Better Future Forward (BFF), a non-profit backed by several foundations and private family endowments. It serves as middleware for schools seeking to offer ISAs, but lacking expertise, funding, or oversight. It currently offers ISAs to vetted programs within a small number of institutions in New York, Minnesota, Wisconsin, and Illinois.

BFF seeks to streamline operations and lower the level of risk for participating schools, while eliminating any credit-bias for under-resourced students. As is the case with Purdue, BFF’s success will be best measured by the ability of its students to meet their income-based obligations.

Alone, ISAs won’t solve our student debt crisis. But in a healthy economy, ISAs signal a willingness to rethink student debt and leverage the expected earnings of recent graduates.

Featuring Eduventures Principal Analyst James Wiley

Since 2014, the first year we published the Higher Education Technology Landscape, we have sought to provide clarity to the confusing and fast-evolving world of higher education technology products in a clear and understandable way. Our goal is to make it easier for leaders to make informed decisions when selecting and implementing technology solutions.

In this webinar, we will walk through the brand new Eduventures 2019 Landscape and our method of inclusion and classification. We will also cover changes to this upcoming Landscape and present key findings on which segments of EdTech are under the greatest pressure to change and which are poised for the greatest growth in 2019.

Thank you for subscribing!