Amid declining enrollment, many institutions look to out-of-state markets for a boost. Often, they assume that successful out-of-state recruitment hinges on choosing markets with a large and growing high-school demographic like Texas, California, or Florida. But in reality, geography alone may not yield the desired results.

Like many things in life, out-of-state recruitment is more complex. For example, rarely do enrollment officers pause to ask: Which of our academic programs should our out-of-state recruiters be prepared to talk about?

Eduventures Admitted Student Research™ shows that asking this question could make a world of a difference.

Market Matters

Every spring, high school seniors tell us which schools they chose to enroll in and what their desired majors of study are. Combining these two questions

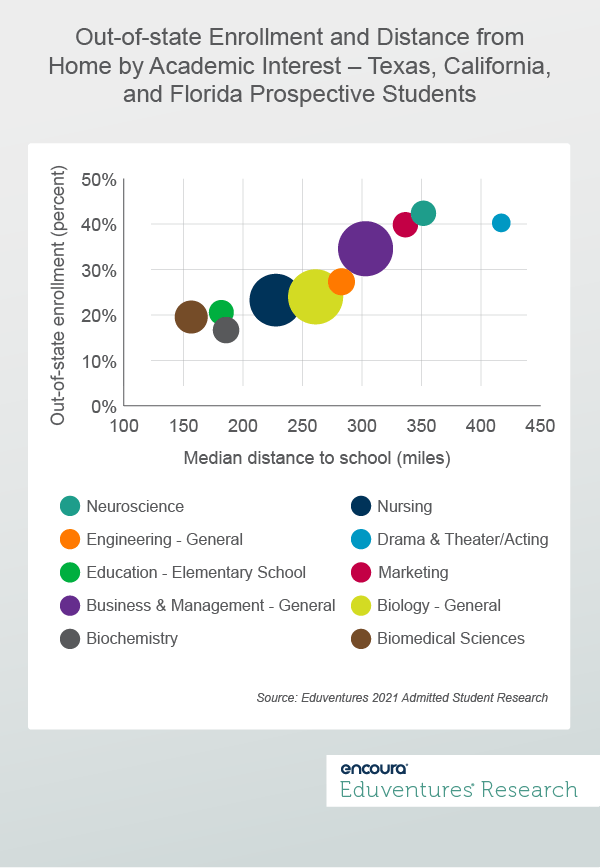

Figure 1 shows the percentage of out-of-state enrollment and median distance between the students' enrollment schools and their home zip codes by select fields of study among students in Texas, California, and Florida—key target states for out-of-state recruitment efforts. The size of the bubble for each major indicates the potential market size (i.e., the number of students interested in studying this field).

Figure 1 reveals that some majors attract a higher proportion of out-of-state students than others. For example, this data shows that students interested in neuroscience, marketing, and drama/acting are most likely to leave their home states for these programs.

But this doesn’t mean there is abundant opportunity for institutions that are trying to recruit students from these states into their drama or marketing programs. The relative size of the bubbles indicates that the number of students interested in these academic fields is relatively small compared to other fields.

Conversely, when we look at market size, nursing and biology stand out as popular programs but offer little opportunity for out-of-state recruitment. Students interested in these programs are more likely to stay at home. So where is the market opportunity?

The data suggests that students interested in business provide a better opportunity since there are many of them, and they are more likely to enroll out-of-state. Students interested in neuroscience or marketing offer smaller pockets of opportunity, while those who want to study biochemistry or biomedical sciences are particularly unlikely to stray far from home.

Geography Matters – But Not the Way You Might Think

So far, we have demonstrated a connection between major interest and willingness to enroll out-of-state, which could impact your odds of recruiting these students. But we do not suggest creating a one-size-fits-all out-of-state recruitment strategy. Rather, it is important to consider geographic differences in student interest.

For example, where are students more likely to be interested in business, or alternatively, in neuroscience and marketing? Figure 2 lists the top 10 academic interests of students nationally, and in Texas, California, and Florida.

Top 10 Fields of Academic Interest by Geography

| National | Texas | California | Florida |

|---|---|---|---|

| Business and Management – General (6%) | Nursing (7%) | Biology – General (7%) | Biology – General (8%) |

| Biology – General (6%) | Business and Management – General (7%) | Business and Management – General (7%) | Computer Science and Information Technology – General (6%) |

| Nursing (6%) | Biology – General (5%) | Nursing (7%) | Business and Management – General (6%) |

| Computer Science and Information Technology – General (5%) | Computer Science and Information Technology – General (4%) | Psychology (excluding counseling) (6%) | Pre-Med (5%) |

| Psychology (excluding counseling) (5%) | Psychology (excluding counseling) (4%) | Computer Science and Information Technology – General (3%) | Nursing (4%) |

| Pre-Med (3%) | Pre-Med (4%) | Environmental Science (3%) | Psychology (excluding counseling) (4%) |

| Mechanical Engineering (2%) | Mechanical Engineering (3%) | Pre-Med (2%) | Biomedical Sciences (3%) |

| Political Science (2%) | Marketing (2%) | Political Science (2%) | Mechanical Engineering (3%) |

| Biomedical Sciences (2%) | Animal Science (2%) | Film - Writing/Production/Studies (2%) | Political Science (3%) |

| Engineering – General (2%) | Biomedical Sciences (2%) | Animal Science (2%) | Biomedical Engineering (3%) |

Figure 2.

In Figure 1 we identified business and management as a key opportunity based on both market size and likelihood of enrolling out-of-state. But by breaking out academic interest by the target state in Figure 2, we see that students in Florida are somewhat less interested in this field of study than students in Texas and California, and especially less than students nationally. We also see that marketing—smaller in terms of market size but promising in terms of interest in out-of-state enrollment—is a better target in Texas than in the other two states.

This suggests that out-of-state recruitment strategy should take into account the academic interest of students in each target state, and potentially even more granularly than that where possible.

Finally, in addition to the size of the graduating high school populations and their academic interests, it is also important to consider the overall likelihood of students from the target state attending an out-of-state school. For instance, 36% of all students in our 2021 national Admitted Student Research sample chose to enroll in schools outside of their home states. This compares to 50% of admits in California, 25% of admits in Texas, and a meager 18% of admits in Florida.

Perhaps, Florida, as promising as it may appear to be in terms of size of the opportunity, is not actually an ideal target market for your out-of-state recruitment efforts. Perhaps, another state with a lower graduating population but greater inclination to enroll away from home—and interest in academic fields that are well-aligned with your institution’s strengths—may provide a better yield opportunity for you.

Either way, one thing is certain; out-of-state target markets must be chosen with great care and deliberation.

The Bottom Line

Recruitment is a big puzzle with many interconnected parts and academic interest is just one of the pieces, albeit an important one. Whether you are trying to break into a new market or retain your position in an established one, understanding the key factors that influence enrollment behavior may give you an advantage in a competitive market.

Rather than choosing out-of-state markets based on demographics alone—along with many other institutions—consider student behavior in that market and your institutional strengths. Then prepare recruiters, in-state and out-of-state, to identify and engage the students and markets that best fit your institution.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Thursday, January 20, 2022 at 2PM ET/1PM CT

Keeping up with the digital landscape is one of the most important things an enrollment marketer can do, but it’s also one of the most challenging things to stay on top of. As Gen Z’s preferences and behaviors have shifted, so has the affinity for favorite apps and social media. Did you know that TikTok just surpassed Google to become the #1 most trafficked site in the world?

Deciding where to invest your time and resources to engage prospective students should go hand-in-hand with where Gen-Z is actually spending time, especially as COVID-19 continues to prevent you from engaging with students face-to-face. Join Jason Stevens, Director of Digital Solutions, as he forecasts our predictions for the digital enrollment landscape in 2022. In this webinar, we’ll cover:

- The importance of personalization in digital marketing and how to effectively scale your approach using Student Mindsets™

- The continued rise of the short video as the new cornerstone for strategic engagement

- Expectations for the most popular platforms in 2022

- How evergreen campaigns can build your brand at any time of the year or admissions cycle

Wednesday January 26, 2022 at 2PM ET/1PM CT

As we kick off a new semester, it's a great time to remember one of your most important stakeholders: alumni. What new strategies do you have for this upcoming semester to engage with your alumni in a refreshing and personal way that reminds them of their pride for your institution?

In this webinar, VP of Encoura Digital Solutions Reva Levin and Director Lyndenise Berdecía will share why an omnichannel approach is the most effective way to connect with alumni and drive genuine giving. They’ll also describe how and when to implement this approach in order to help any institution have a more successful giving season.

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values so you can create a productive and distinctive program portfolio.