Seven months into the pandemic, prospects for a rapid economic recovery are dimming. The persistence of COVID-19, and an evaporation of federal stimulus aid signal rough waters ahead for many postsecondary institutions, particularly community colleges.

But amid these darkening clouds, there are signs of new thinking from the “education-as-a-benefit” marketplace. Could now be the moment to unlock the billions of dollars in existing capital spent annually by employers on educational benefits?

While education-as-a-benefit predates 2020, a grand experiment could be emerging in how this sector could enable frontline workers to obtain post-COVID-19 skills and credentials, leveraging investments from their employers.

Unlocking Education Benefits Capital

Guild Education may be the best known education-as-a-benefit provider, but it’s hardly alone in its effort to rationalize the educational benefits ecosystem. Competitors include Pearson’s Accelerated Pathways, Bright Horizon’s EdAssist, and Arizona State University's InStride, offering solutions that connect employees of Fortune 1000 companies with curated certificate or degree completion pathways. Other solutions are also emerging from Coursera, edX, and LinkedIn Learning.

While service models vary, these companies share several goals:

- Create mutually beneficial networks of employers and colleges.

- Provide employers and their employees with special education benefits and customization to encourage enrollment, attract talent, and boost employee retention, while providing schools with a powerful recruitment pipeline.

- Commoditize education benefit administration and return-on-investment for companies, and lower enrollment costs for schools.

A 2019 study by the International Foundation of Employee Benefit Plans (IFEBP) suggest that these providers are on the right track. IFEBP’s analysis of 772 employee benefit specialists representing a broad cross-section of U.S. employers revealed several relevant trends. Sixty-three percent of respondents reported that they provide some type of tuition assistance or reimbursement plan, including making payments on employees' existing student loans. Among these companies, the top three motivations for doing so included “attract future talent” (77%), “retain current employees” (58%), and “increase employee satisfaction and loyalty” (56%).

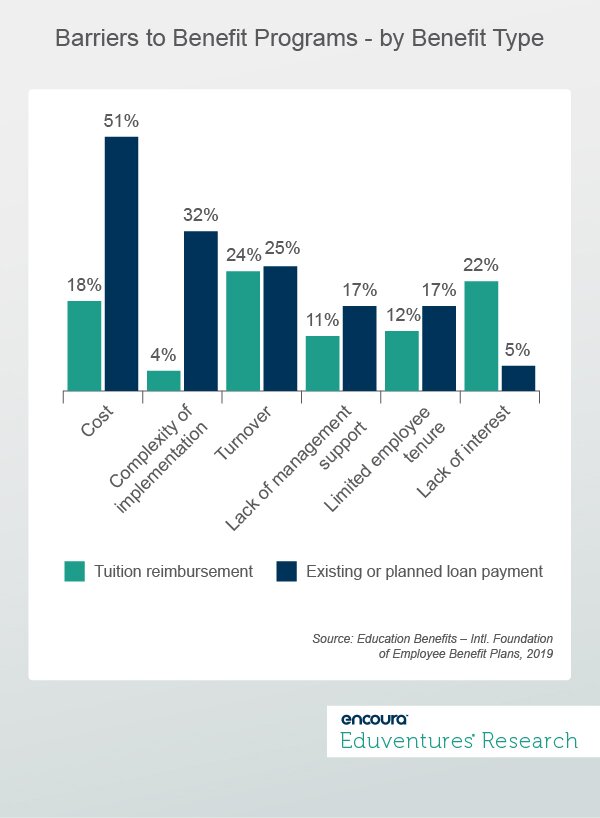

When asked to identify obstacles to expanding these programs, however, companies expressed concerns over cost, complexity, and the likelihood that their investment would walk out the door when an employee moved onto a new job (Figure 1).

These findings suggest that more employers could be motivated to maximize the education benefits they extend to their employees, if these benefits came with reduced complexities and costs, or if they were seen to improve retention. This is the niche that the education-as-a-benefit sector is trying to exploit.

A Sign of the Times? Strategic Education’s Partnership with Noodle Partners

The education-as-a-benefit strategy is at the core of a recent and intriguing partnership. Strategic Education Inc. (SEI), owner of for-profit Capella and Strayer Universities, has joined with Noodle Partners, best known for its online program management (OPM) business, to offer a new platform, WorkforceEdge. While both Capella and Strayer have a long history of providing working adults with a variety of workplace-focused credentials, they have targeted individuals over companies. In the wake of challenging enrollment trends and regulatory pushback facing for-profit schools, SEI is betting that long-term stability will come from employer benefits rather than federally-subsidized tuition.

According to CEO Karl McDonnell, SEI expects to “transition our tuition revenue to private sector employers over the next 10 years.” In theory, WorkforceEdge will aggregate enrollment from Noodle’s growing cadre of institutional partners, not just SEI. While this construct represents a pivot for both SEI and Noodle, it signals an important endorsement of the education-as-a-benefit approach.

The idea of unlocking existing capital and deepening educational benefits for frontline workers is also attracting the attention of investors. Since its inception, for example, Guild Education has attracted $228,500,000 in venture capital investment. While start-up valuations are often viewed as more art than science, Guild announced a valuation of $1 billion in September 2019.

There’s no doubt that Guild has built an impressive roster of corporate clients, such as Chipotle, Walmart, Disney, and Lowe’s. Guild claims to have helped more than 30,000 students complete or continue a postsecondary credential and that 10,000 adult learners inquire about its services each month. Presumably, these enrollees and prospects are distributed across multiple corporate partners and postsecondary institutions.

The Bottom Line

Raw demand for more skills and credentials will not be an issue for the education-as-a-benefit approach: Eduventures’ June 2020 Adult Prospect COVID-19 Impact Survey revealed that 43% see the pandemic “as my wake-up call to develop new skills” to reduce vulnerability to future unemployment. According to Strada Education’s biweekly assessment of the impact of COVID-19, 47% of working adults agree that they will need more education to respond to potential layoffs.

But actual enrollment rates are always much lower. If expansion of education-as-a-benefit firms can help overcome consumer reticence about paying for school, at least among employees of larger companies, colleges and universities would welcome such market expansion.

The question, however, is whether employers will recognize the value of the education-as-a-benefit model. The line between education benefits driving employee retention vs. departure is blurred, and hard for schools or employers to manage. Schools have always struggled to transcend transactional discounting and really penetrate corporate strategic thinking.

Adult-focused postsecondary institutions would be wise to pay close attention to this marketplace. If these providers can reduce the friction between what employees want, what employers want (and will fund) and what schools provide, more doors could open at more institutions. This could mean a stronger enrollment pipeline of frontline workers in need of new skills and credentials.

For decades, individual schools have wooed local companies with discounts and custom programs. But unlocking and redirecting educational benefits at scale may require the network approach of the likes of Guild and WorkforceEdge.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

Thursday, October 15, 2020 at 2PM ET/1PM CT

Eduventures’ Prospective Student Research represents the largest student market segmentation and institutional identity study in the country, revealing the preferences of Gen Z college-bound students, including our Student Mindsets™. Join Kim Reid and Brent Ramdin on Thursday, October 15th at 2pm ET to learn how you can apply Prospective Student Research to immediately improve student engagement for both your application and inquiry generation efforts.