Learn more about how we built the Tech Landscape by reading our methodology.

During the development of the Eduventures 2017 Higher Education Technology Landscape, our analyst team encountered a unique and challenging decision point: with so many kinds of companies entering the higher education fray, where do we draw the line on which companies to include? Namely, should we include a broader set of higher education services as part of our core map or just stick with companies that make software products?

We struggled internally—with much debate—over this decision. On the one hand, services are an integral part of making these products work for institutions. Rarely do institutions hold a competitive bidding process for a software solution and not consider some sort of wrapper services from the same vendors. On the other hand, services engagements vary wildly regarding requirements, technology scope, and implementation timelines, making it very hard to measure and compare the quality, cost, and client satisfaction levels of a services engagement in a fair and equitable manner.

Ultimately, we made a conscious decision to exclude service-based companies that do not provide edtech products to higher education from the landscape this year. This decision resulted in the removal of a handful of vendors, particularly in market segments that one typically associates with professional service organizations and consultants.

For example, most notably, we removed well-known brands such as Deloitte and Accenture from the System Integration Solutions and Implementation Support market segment. While this type of vendor provides valuable services to institutions during the implementation of large, enterprise software platforms, these companies do not sell actual products themselves. In this case, we instead included more tools like integration platform as a service (iPaaS) and products from other middleware providers to round out this segment.

Take the example of an early stage edtech startup with less than five clients. This period is usually the time between bootstrap funding and a company’s first serious capital raise, and most are less than two years old. The clear majority of the vendors that exhibited at the recent LearnLaunch 2017 conference in Boston would fall into this category. Alpha and beta users of new edtech products typically receive a lot of care and attention from their vendors to ensure that they are properly trained, actively using the product, and soundly integrated into their existing ecosystem. In most cases, vendors provide this additional level of service at little to no cost for early adopters.

This additional level of service is a smart investment on the part of the vendor, albeit quite an expensive one. Happy clients are reference-able clients, and these companies are banking on adopters becoming their champions, leading to new prospects and sales. Increasingly, institutions expect that subscription costs for SaaS products should include training, support, and implementation fees. This expectation creates tension for vendors struggling to balance as many services as possible at no additional cost, with the fixed costs of providing services that are dependent on human capital.

As vendors mature and need to show profit across all revenue channels, including both products and services, clients should expect to see price expansions for these services. Year-over-year cost increases allow vendors to achieve “break-even” goals over the life of the relationship. Or at a minimum, institutions should recognize that there is a real risk that the quality of services may diminish as a company hits its stride and has many more clients to support.

Evaluating, comparing, and getting the most out of these services is sometimes more art than science. It is important to keep in mind that while we have not included many professional services companies in this year’s report, we do have ongoing advisory discussions with our clients about the services they provide and whether they represent a good fit. Hopefully you, our reader, now have a greater appreciation for how we reached our decision to annex service-only providers from this year’s technology landscape and we welcome your ongoing feedback.

Take the example of an early stage edtech startup with less than five clients. This period is usually the time between bootstrap funding and a company’s first serious capital raise, and most are less than two years old. The clear majority of the vendors that exhibited at the recent LearnLaunch 2017 conference in Boston would fall into this category. Alpha and beta users of new edtech products typically receive a lot of care and attention from their vendors to ensure that they are properly trained, actively using the product, and soundly integrated into their existing ecosystem. In most cases, vendors provide this additional level of service at little to no cost for early adopters.

This additional level of service is a smart investment on the part of the vendor, albeit quite an expensive one. Happy clients are reference-able clients, and these companies are banking on adopters becoming their champions, leading to new prospects and sales. Increasingly, institutions expect that subscription costs for SaaS products should include training, support, and implementation fees. This expectation creates tension for vendors struggling to balance as many services as possible at no additional cost, with the fixed costs of providing services that are dependent on human capital.

As vendors mature and need to show profit across all revenue channels, including both products and services, clients should expect to see price expansions for these services. Year-over-year cost increases allow vendors to achieve “break-even” goals over the life of the relationship. Or at a minimum, institutions should recognize that there is a real risk that the quality of services may diminish as a company hits its stride and has many more clients to support.

Evaluating, comparing, and getting the most out of these services is sometimes more art than science. It is important to keep in mind that while we have not included many professional services companies in this year’s report, we do have ongoing advisory discussions with our clients about the services they provide and whether they represent a good fit. Hopefully you, our reader, now have a greater appreciation for how we reached our decision to annex service-only providers from this year’s technology landscape and we welcome your ongoing feedback.

Professional Services in the Context of EdTech

We recognize, however, that institutions must consider the quality and breadth of professional services available—including training and support—when evaluating new technology products. An implementation’s success depends less on software configuration and installation and related integrations and more on the ability of administrators, faculty, staff, and students to maximize the daily use of their learning environment. Vendors provide a plethora of professional services alongside their technology products that fall into the following categories:- Strategic Planning: Assess the business needs of an institution and recommend a course of action for meeting organizational goals and objectives.

- Change Management: Assist stakeholders in reallocating resources (budgets), assess current operations and promote new business processes where appropriate.

- Implementation: For a particular technology platform, perform the initial installation, deployment, and configuration up to the point of initial operational capability.

- Training: Educate end users and stakeholders in the operation of the technology platform.

- Customer Support (Helpdesk): Provide a feedback mechanism and resolution process for bugs, defects, and enhancements to the existing technology.

- Adoption: Spur engagement with new user groups, or expand usage by existing stakeholders for an established technology.

Introducing the EdTech Services Maturity Model

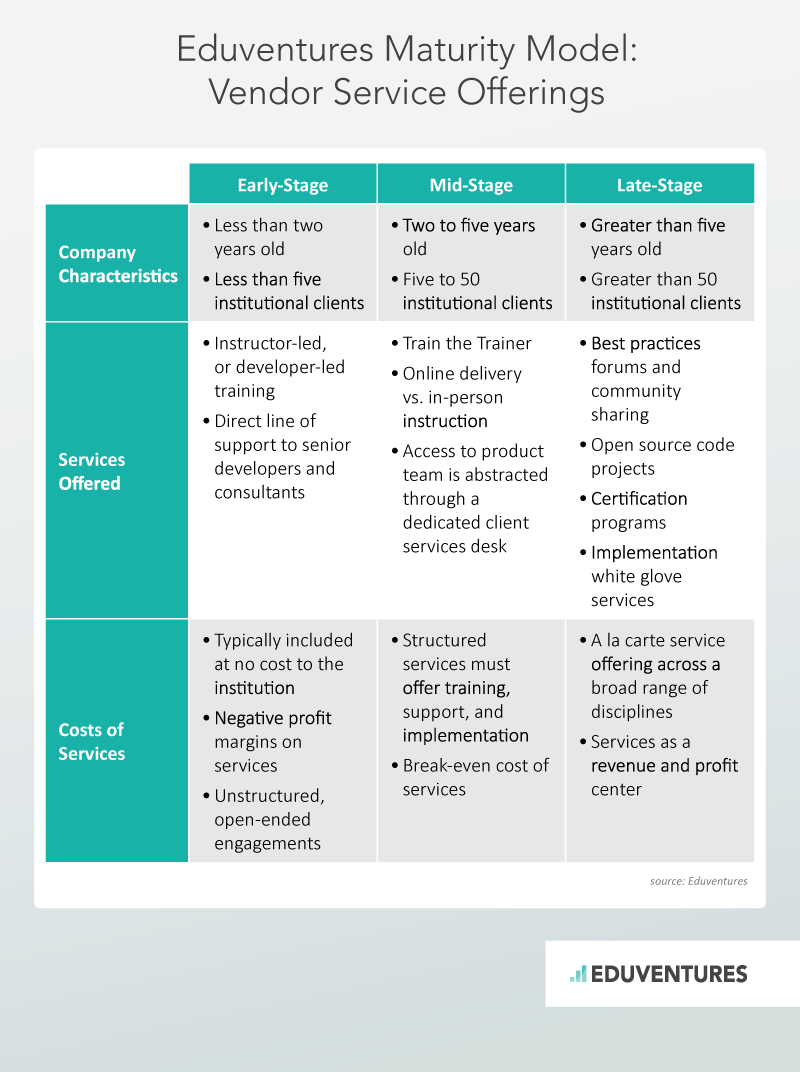

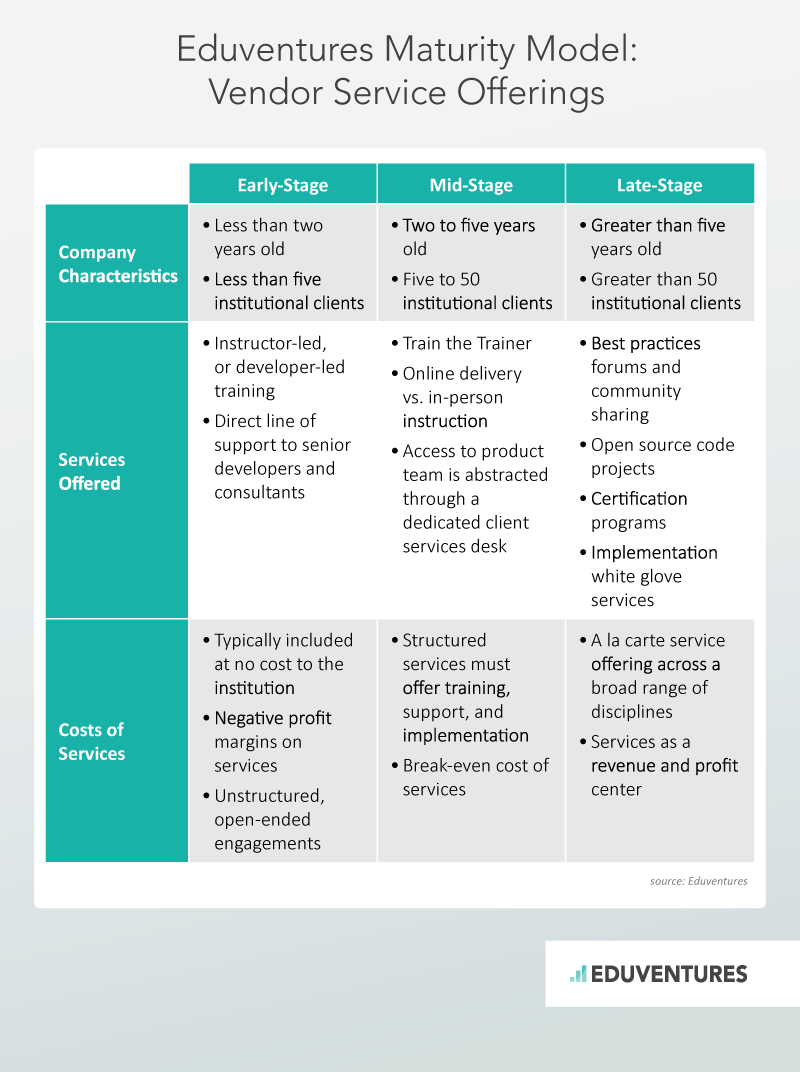

We’ve also found a correlation between the quality of services, responsiveness of vendor staff, and the age of a company or the total number of clients that they support. Early stage companies typically provide a very high level of services and low to no cost to early adopters. Middle stage companies start to draw back on the quality or amount of services offered on a per-client basis as they scale and expand operations. Late stage, established companies regain mature service offerings, but those services typically come at a premium price point and are not included in the base subscription or licensing costs. Take the example of an early stage edtech startup with less than five clients. This period is usually the time between bootstrap funding and a company’s first serious capital raise, and most are less than two years old. The clear majority of the vendors that exhibited at the recent LearnLaunch 2017 conference in Boston would fall into this category. Alpha and beta users of new edtech products typically receive a lot of care and attention from their vendors to ensure that they are properly trained, actively using the product, and soundly integrated into their existing ecosystem. In most cases, vendors provide this additional level of service at little to no cost for early adopters.

This additional level of service is a smart investment on the part of the vendor, albeit quite an expensive one. Happy clients are reference-able clients, and these companies are banking on adopters becoming their champions, leading to new prospects and sales. Increasingly, institutions expect that subscription costs for SaaS products should include training, support, and implementation fees. This expectation creates tension for vendors struggling to balance as many services as possible at no additional cost, with the fixed costs of providing services that are dependent on human capital.

As vendors mature and need to show profit across all revenue channels, including both products and services, clients should expect to see price expansions for these services. Year-over-year cost increases allow vendors to achieve “break-even” goals over the life of the relationship. Or at a minimum, institutions should recognize that there is a real risk that the quality of services may diminish as a company hits its stride and has many more clients to support.

Evaluating, comparing, and getting the most out of these services is sometimes more art than science. It is important to keep in mind that while we have not included many professional services companies in this year’s report, we do have ongoing advisory discussions with our clients about the services they provide and whether they represent a good fit. Hopefully you, our reader, now have a greater appreciation for how we reached our decision to annex service-only providers from this year’s technology landscape and we welcome your ongoing feedback.

Take the example of an early stage edtech startup with less than five clients. This period is usually the time between bootstrap funding and a company’s first serious capital raise, and most are less than two years old. The clear majority of the vendors that exhibited at the recent LearnLaunch 2017 conference in Boston would fall into this category. Alpha and beta users of new edtech products typically receive a lot of care and attention from their vendors to ensure that they are properly trained, actively using the product, and soundly integrated into their existing ecosystem. In most cases, vendors provide this additional level of service at little to no cost for early adopters.

This additional level of service is a smart investment on the part of the vendor, albeit quite an expensive one. Happy clients are reference-able clients, and these companies are banking on adopters becoming their champions, leading to new prospects and sales. Increasingly, institutions expect that subscription costs for SaaS products should include training, support, and implementation fees. This expectation creates tension for vendors struggling to balance as many services as possible at no additional cost, with the fixed costs of providing services that are dependent on human capital.

As vendors mature and need to show profit across all revenue channels, including both products and services, clients should expect to see price expansions for these services. Year-over-year cost increases allow vendors to achieve “break-even” goals over the life of the relationship. Or at a minimum, institutions should recognize that there is a real risk that the quality of services may diminish as a company hits its stride and has many more clients to support.

Evaluating, comparing, and getting the most out of these services is sometimes more art than science. It is important to keep in mind that while we have not included many professional services companies in this year’s report, we do have ongoing advisory discussions with our clients about the services they provide and whether they represent a good fit. Hopefully you, our reader, now have a greater appreciation for how we reached our decision to annex service-only providers from this year’s technology landscape and we welcome your ongoing feedback.