Many big employers have increased their education benefits in the past decade to attract and retain employees—Starbucks, Amazon, Walmart, and others have announced programs to educate and upskill their workforces. With concerns about affordability among students and ongoing labor market tightness impacting college enrollment, this presents an opportunity for both parties.

According to the Eduventures Adult Prospect Survey™, nearly a third of adult prospects have access to employee education benefits. Less than half of these, however, actually use them, suggesting a widespread disconnect between wanting them and using them.

What can institutions do to tap into this growing market of adult prospects with education benefits?

Employer education benefits are nothing new—many companies have provided them for 20 years or more. (Notably, most adhere to the federal cap on tax-free money that they can contribute to employees, which has not budged from $5,250 since 1986—the equivalent of $14,770 in today’s dollars!)

But splashy announcements of expanded benefits from several large companies have attracted a surge of attention in recent years. Indeed, these companies have an outsized influence on the market—in 2022, less than 1% of companies had 1,000 or more staff but employed 42% of the American private sector workforce.

A 2019 survey by the International Foundation of Employee Benefit Plans found that 92% of U.S. organizations offer some form of educational benefit for employees. A 2022 report from Society for Human Resource Management (SHRM) found that 48% of employers offer undergraduate or graduate tuition assistance as a benefit.

Given the increasingly competitive market for adult and graduate students, many institutions have tried to tap into these companies’ workforces to augment their enrollment funnels. But this is easier said than done.

This challenge has directly led to the rise of B2B education benefits intermediaries like Guild, InStride, and EdAssist that streamline the process for companies, connecting their employees with a catalog of (mostly online) non-degree, bachelor’s, and master’s degree offerings. But the opportunity to partner with a B2B intermediary has slowed, especially since these companies tend to prefer institutional partners with large online catalogs.

Education Funding Sources

Eduventures’ Adult Prospect Survey asks students which funding sources they expect to use to pay for their educations. The top sources of funding include grants and scholarships, cash/savings, and loans. But as many as 30% expect to use money from their employers.

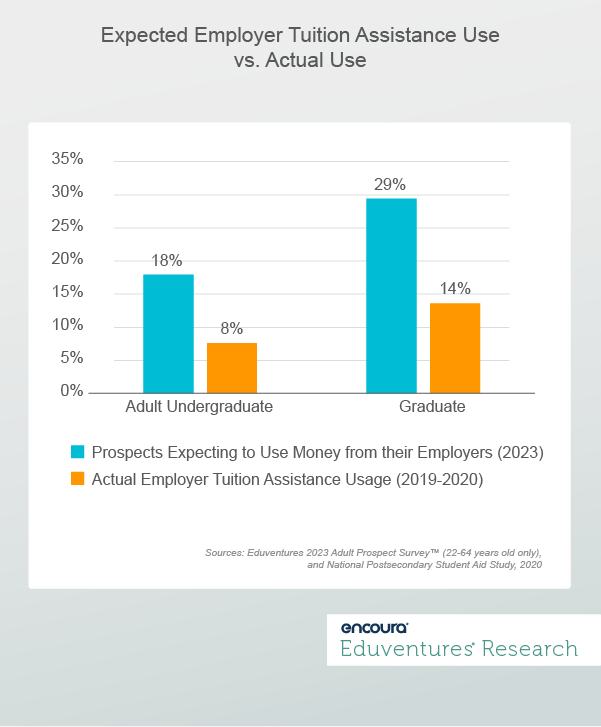

In Figure 1, we matched our data about intended use with actual usage data from the National Postsecondary Student Aid Study to approximate how often this benefit is actually used.

Figure 1.

While nearly 30% of graduate prospects indicate they expect to use money from their employers, just 14% of graduate students actually do—about half. Similarly, about 18% of adult undergraduate prospects indicate they expect to use money from their employers as a source of funding but just 8% of adult undergraduates (age 24+) actually do.

To understand what is happening here, we asked those who intended to use money from their employers a few additional questions.

How Prospects View Tuition Assistance

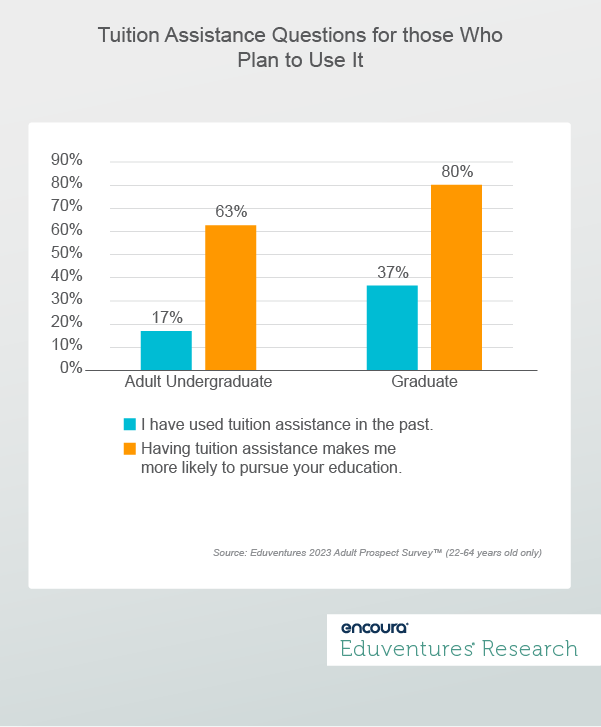

Among all adult prospects who expect to use employer tuition assistance, 28% indicated they had used it in the past while 69% had not. Additionally, a significant majority (72%) reported that having tuition assistance benefits makes them more likely to pursue education. But we see important differences between undergraduate and graduate populations, see Figure 2.

Figure 2.

Just 17% of adult undergraduates had used tuition assistance in the past, compared to 37% of graduate prospects. Nearly two-thirds (63%) of adult undergraduates indicated that having tuition assistance made them more likely to pursue education compared to 80% of graduate prospects.

This suggests that employer education benefits are particularly underutilized among those who do not yet have a bachelor’s degree and could reveal a disconnect between employers, their employees, and educational offerings.

What are some of the reasons for the disconnect? First, the education that an employee may pursue typically must align with their current role or function so the employer can identify the potential return-on-investment. If an employee does not like their role or function, pursuing education would not be a top priority.

Secondly, and most importantly, the financial limit of $5,250 is not enough to cover most degree programs, especially bachelor’s degrees. The reason large companies make news with education benefit initiatives is because they are willing to pay above that limit for employees’ bachelor’s degrees (especially with the assistance of B2B intermediaries like Guild and InStride), which is outside the norm of tuition assistance programs.

The $5,250 cost limit, however, is aligned with many non-degree courses and certificate options. These non-degree programs can be attractive to both employees and employers—they are faster to complete, more focused, and often emphasize in-demand skills.

Demand for high ROI programming (high-impact, low-cost, and fast) is one factor driving the growth of non-degree credentials among institutions and corporate providers. Improved usage of tuition assistance could come with increasing the financial limit, but institutions need to maximize what they can do within the existing framework rather than wait around for congressional action.

The Bottom Line

As the tight labor market continues, companies will continue to dangle this education benefit carrot to improve their employee recruitment and retention efforts. While tuition assistance has become a popular employee benefit, our research shows that a minority of prospects use it. This segment of prospective students needs to be cultivated by institutions, but that is easier said than done.

Here are some strategies for institutions to find, attract, and enroll these prospects:

- Know your regional employers. Proactively connect with local and regional employers that have tuition assistance programs, establish mutual partnerships, and generate awareness about the partnership and educational programming available.

- Tailor programs, to an extent. Companies are often looking to solve specific challenges or meet certain goals. Look to collaborate with employers to align with their needs and your institutional offerings. The key is to ensure that new programs are designed to scale to a broader audience, not just the specific partner.

- Step up student services. Students using tuition assistance are working, so institutions need to offer advising, tutoring, and other support functions available when they have time. These adult students can benefit from streamlined processes including flexible payment options when tuition assistance will not cover everything.

These strategies can be the beginning of a more comprehensive corporate outreach and partnership strategy. It is important to remember that this takes time and resources and is not likely a quick win. But institutions need to think long-term about how best to build sustainable adult, online, and graduate recruitment funnels.