Last year, following the first decrease in graduate enrollment in more than a decade, Eduventures speculated about whether the “graduate enrollment party” may finally be over. The major takeaway: institutions should no longer rely on steady graduate enrollment growth to balance out shrinking undergraduate enrollment.

Fall 2023 data published by the National Student Clearinghouse (NSC), however, indicated that graduate enrollment increased a little between 2022 and 2023, reversing the previous year’s trend. Since then, Eduventures’ most recent Adult Prospect Research™—which provides a strong indicator for future demand—shows increasing enrollment interest in graduate programs. What does this mean for institutions and their graduate programs going forward?

Figure 1 tracks the growth of the graduate market. It saw the largest enrollment growth (3%) between fall 2019 and fall 2020, primarily due to pandemic-induced layoffs and furloughs. In fall 2021, however, total graduate enrollment eclipsed 3 million—the most ever. Graduate enrollment was riding high, and some expected the growth to keep coming.

Figure 1.

The decline in overall graduate enrollment in fall 2022 was driven by master’s degree enrollment, which shrank by 1.5% between 2021 and 2022. Despite the much-hyped rise in non-degree demand over this period, master’s degrees remain the bulk of graduate enrollments.

In fall 2023, master’s degree programs had over 2 million total enrollments, accounting for 65% of all graduate enrollment. By comparison, the (for-credit) graduate certificate market had just under 90,000 enrollments in fall 2023, accounting for a meager 3% of all graduate enrollment. Doctoral and professional degrees accounted for 31% of graduate enrollment with just under 1 million enrolled in fall 2023.

Now, fall 2023 graduate enrollment data points to slight overall growth (0.6%) compared to fall 2022. In fact, total enrollment in 2023 is still larger (about 3.1 million) than every other year except 2021. How should institutions interpret such information?

Was the Decline a Mirage?

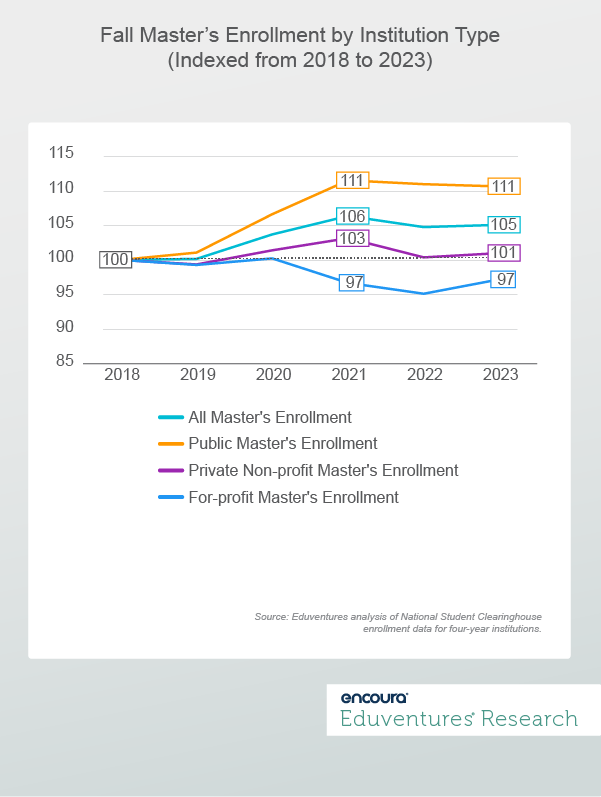

So, what happened in the master’s market? Figure 2 shows that master’s degree enrollment grew by 5% between 2018 and 2023, but this played out differently based on school and program type.

Figure 2.

Figure 2 points to a shift in graduate prospect preferences, pointing strongly in the favor of public institutions:

- Public four-year master’s enrollment grew by 11% between 2018 and 2023.

- Private non-profit master’s enrollment peaked in 2021 and has now come back down to 2018 levels with just 1% growth over that time.

- Private for-profit institutions, on the other hand, saw a decline in 2021 and have been lower than the 2018 total master’s enrollment, while the rest of the market has grown.

Eduventures’ Adult Prospect Survey (APS), the proprietary longitudinal survey that tracks future demand among prospective adult learners, also shows some promising trends. Most notably, after years of decline from 2019 to 2022, we see a large increase (+8%) in the percentage of “committed” master’s prospects—those prospects that indicate they will enroll.

These “committed” master’s prospects have historically preferred public institutions, likely because of the large breadth of programming and affordability, with no discernable changes in preference over time for both private non-profit and for-profit institutions.

Enrollment Declines vs. Future Prospects

NSC master’s enrollment shows the three largest fields of study (accounting for over 50% of enrollment): business, health professions, and education. All saw enrollment declines between fall 2022 and 2023 (-2%, -1.7%, and -2.3%, respectively), which was a continuation of decline from the record high enrollment in 2021.

“Committed” master’s prospects have long preferred business as the top field of study. The next most preferred fields include health professions, education, and computer and information sciences. Though education preference has seen decline over time, computer and information sciences have increased.

Some fields of study saw robust year-over-year enrollment growth, including multi/interdisciplinary studies and computer and information sciences (+25% and +14%). Notably, data science and data analytics programs fall under multi/interdisciplinary studies, explaining that huge growth percentage.

The Bottom Line

The reversal of graduate enrollment decline paired with increased graduate prospect interest indicates that all is not lost. At the same time, some institutions and program disciplines could continue to face enrollment challenges. Even in the STEM fields experiencing rapid growth, there is also a risk of oversupply as just about every institution is entering or expanding their offerings in these areas.

Overall, these enrollment patterns follow what Eduventures predicted in our most recent Master’s Market Update report: we expect that master’s enrollment will continue to grow modestly for the next couple of years, through 2025, but will have a gradual decline into the 2030s.

With the forecast of a long-term plateau in the master’s market, we believe institutions need to evaluate graduate programs now, especially as competitive pressure increases. Institutions need to identify and prioritize new program growth opportunities now more than ever. At the same time, they must review existing programs to make sure they keep up with the changing times.