One issue has increasingly crept into casual conversations this holiday season: the global supply chain. The supply chain encompasses all those activities required by companies to deliver goods to consumers—from the sourcing of raw materials to the delivery of a package on your doorstep—and, depending on who you ask, supply chain issues are either easing or they aren’t going anywhere.

Either way, it is hard to deny that the supply chain has been thrust under the public microscope. Whether current challenges have been caused or exacerbated by the pandemic, what better time to assess the supply chain program market and determine the academic program opportunity within?

Trending Up

We’ve all seen the headlines. Ports are backed up, truck drivers are scarce, and American consumers aren’t slowing down despite inflation. But consumer wants and needs aren’t the only things on the rise.

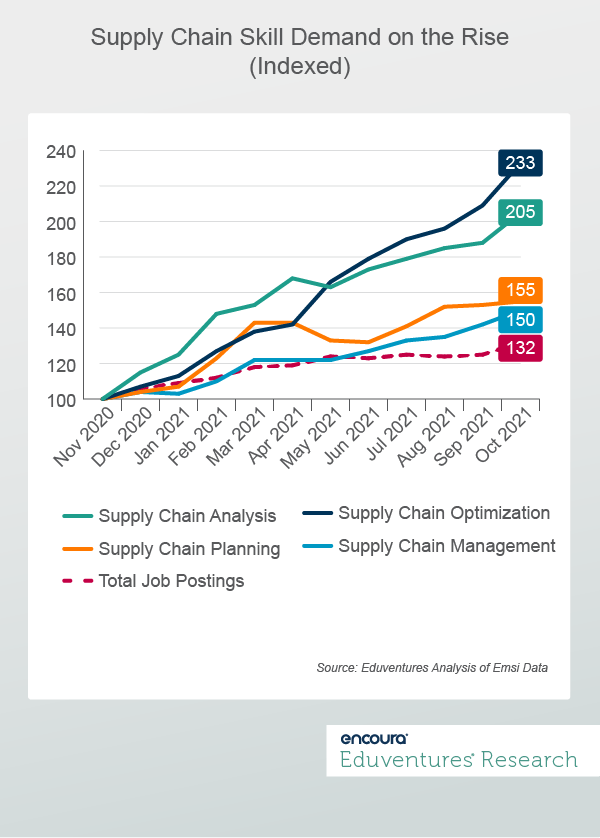

In fact, as Figure 1 displays, these job postings containing key supply chain skills have outpaced all total job postings over the last year.

Certainly, the opportunity appears to be trending up for programs that produce supply chain management professionals. But the snapshot here only captures the last 12 months. Do longer-term occupational projections and historical program market data back this rosy picture up?

Parsing the Data

From 2021 to 2030, occupations directly linked to supply chain management programs are projected to grow above average overall (9% vs. 6%), but the detailed view is a bit more complicated. While logisticians, those tasked with analyzing and coordinating an organization’s supply chain, are projected to grow significantly above average (19%) through 2030, industrial production managers (3%), purchasing managers (3%), and transportation, storage, and distribution managers (5%) are projected to grow below average during the same time.

On a high note, logisticians represent the largest occupational group of the four and is projected to see over three times the number of new jobs (41,499) added over the next decade compared to the other three occupations combined (13,760).

There are tangential occupations, too, that warrant a look. The supply chain has increasingly embraced software, predictive analytics, and artificial intelligence to keep things sourced, produced, shipped, and delivered on time. Software developers (21%), data scientists (24%), and operations research analysts (18%) are all projected to see well above-average growth over the next decade. With relevant job postings trending up, occupational outlook, while not as cut and dry, certainly points to opportunity.

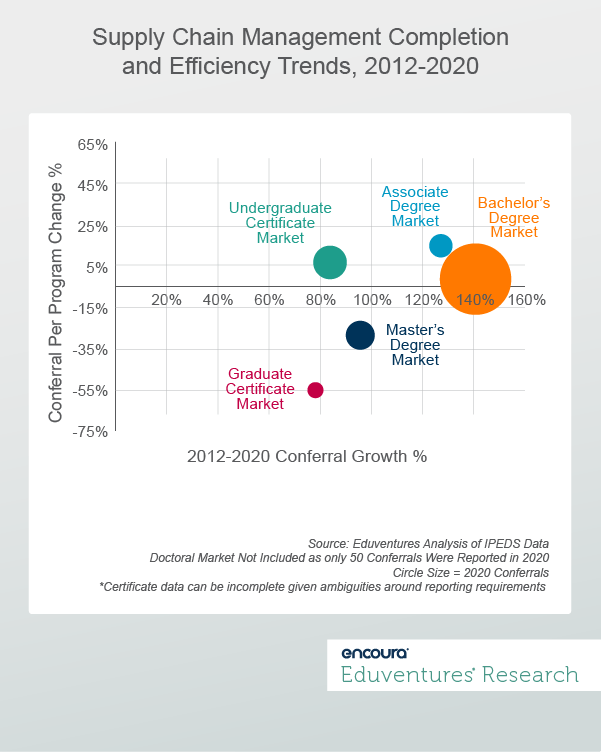

What signals do we observe from the academic program market? Figure 2 plots out relevant degree and for-credit certificate trends for the logistics, materials, and supply chain management program market.

The bachelor’s market is by far the largest credential market for supply chain management reporting 6,501 conferrals (66% of all completions in Figure 2), while the graduate certificate market is the smallest with just over 260 completions reported in 2020. All supply chain management degree and certificate markets saw conferral growth of over 75% between 2012-2020, which is far above the averages for each credential market and a strong signal for student demand.

A clear trend develops, however, when you consider market efficiency over time (i.e., how conferrals per program have trended in a given market). As Figure 2 shows, the graduate supply chain management market, defined as graduate certificates and master’s degrees, became less efficient while the undergraduate market became more efficient during the examined window.

For example, the supply chain master’s market saw a 25% decrease in efficiency during this time, which outpaced overall master’s trends (-10%). In contrast, the supply chain bachelor’s market saw a 4% increase in efficiency, which outpaced the overall bachelor’s market (2%).

What caused the graduate market to become less efficient given healthy conferral growth? It was the sheer program explosion reported at that level. While master’s conferrals almost doubled between 2012-2020, master’s programs grew by 163%, jumping from 24 to 63 programs.

Similarly, graduate certificate completions grew by 78% between 2012-2020, while programs exploded by 283% jumping from 12 to 46 programs. With program growth outpacing conferrals at the graduate level, this market has simply become inundated with competition. At the same time, there does not appear to be an overwhelming need for logisticians—the largest and fastest growing directly-aligned occupation—to attain a graduate credential. Only 10.4% of that workforce has a master’s degree, which is slightly below average for all U.S. occupations (10.6%).

The Bottom Line

Market indicators point to the bachelor’s market as the most favorable opportunity in the supply chain management area. It is the largest and fastest growing credential market of those analyzed and has seen positive efficiency gains in recent years. At the same time, three of the four linked occupations signal a bachelor’s degree as the typical entry-level education, while those three occupations (logisticians, industrial production managers, and purchasing managers) also report higher-than-average proportions of bachelor’s degree holders in the workforce.

So, is it full steam ahead in the supply chain management bachelor’s market?

Not quite. While most indicators look positive, there is hidden competition in this market that the data here doesn’t account for—in the form of general business bachelor’s programs with supply chain management concentrations. A quick web search finds a list that is not lacking, including programs like Virginia Commonwealth University’s B.S. in Business concentration in Supply Chain Management and Analytics, Colorado State University’s Business Administration Major’s concentration in Supply Chain Management, and DePaul University’s B.S. in Management’s concentration in Supply Chain Management (notably, the already saturated supply chain master’s market suffers from the same issue as MBA programs and aligned concentrations further compounding competition at the graduate level).

While demand for supply chain management bachelor’s programming is clear, competition is tighter than it first appears.

Additionally, certain characteristics signal that schools with a specific profile have historically performed best in this market. In 2020, 80% of supply chain management bachelor’s conferrals were claimed by public institutions (compared to 66% of all bachelor’s conferrals). Seventy-two percent were claimed by R1’s and R2’s (compared to 49% of all bachelor’s conferrals) and 85% were from four-year institutions with enrollment of 10,000 or more (compared to 63% of all bachelor’s conferrals). Schools not fitting this profile may find the market tougher to crack unless they possess truly compelling program features.

The risk with high-flying program opportunities is a rush to market that quickly overwhelms student and employer demand. But a school that is able to stake its ground and show results producing supply chain professionals for the future may very well capture this market momentum.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Wednesday January 26, 2022 at 2PM ET/1PM CT

As we kick off a new semester, it's a great time to remember one of your most important stakeholders: alumni. What new strategies do you have for this upcoming semester to engage with your alumni in a refreshing and personal way that reminds them of their pride for your institution?

In this webinar, VP of Encoura Digital Solutions Reva Levin and Director Lyndenise Berdecía will share why an omnichannel approach is the most effective way to connect with alumni and drive genuine giving. They’ll also describe how and when to implement this approach in order to help any institution have a more successful giving season.

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values so you can create a productive and distinctive program portfolio.